|

Are you one of those folks who continually worries about affording life in retirement? Do you frequently fire-up your spreadsheets and plug in numbers from your latest retirement plan…only to learn you’re not quite there yet? Have you been convinced to make a timesharing commitment, as part of your “affordable retirement” strategy but wonder what impact that will have on your finances? Well, if you find yourself in any of these situations, then take (small!) comfort knowing that you’re not alone. Surprising Truth about Retirement AffordabilityMillions of people like you battle the eternal question: Am I retirement ready, and how do I retire comfortably with my nest egg? But guess what? Despite everything that your financial “advisor” may tell you – about needing a 7-figure nest egg to retire comfortably, you’ll be amazed at just even a moderate-sized nest egg can accomplish. If you think a 2-week time sharing arrangement will help ease the burden of your retirement plans, how about...

Strewn across the world, in safe, friendly jurisdictions, with agreeable climate and plenty of luxurious amenities, are retirement harbors where you can:

What Makes Overseas Retiring AttractivThe relative strength of your current savings means you’ll enjoy a much favorable parity between local currency and your home currency. Great climate. Friendly people. Affordable housing and healthcare. Combine all these together, and overseas is the perfect solution for an affordable retirement that’ll see your nest egg stretch farther than if you retired at “home”. Retirees in a high tax bracket at home may find overseas retirement especially attractive. If you choose a jurisdiction with a low-tax rate, which many of them are, or one with no tax at all, you’ll enjoy tax-free or tax-advantaged growth of your investments. That too enables retirees to stretch their nest egg farther than they could dream it would go if they retired at home. Unlocking Retirement CapitaYour first step in planning your overseas affordable retirement is to unlock all avenues of retirement capital. And, one of the greatest sources of that locked-in capital is an often-impulsive timesharing investment, brought about by aggressive, and often misleading sales pitches. Once invested, if they aren’t outright scams, timeshare companies often make it extremely challenging for investors to exit their fractional ownership. Often, it’s the eagerness to avoid this up-hill battle that then keeps investors tied to an investment that:

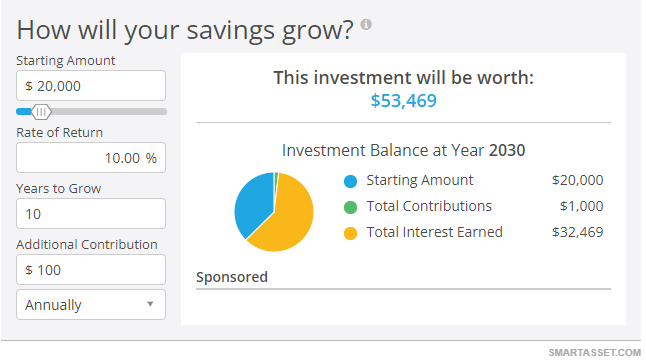

So, assuming you recover $20,000 from what you thought was a sunk investment. What could you do with those funds over a 10-year horizon until retirement? Well, the one thing that you shouldn’t do is invest in another timeshare! But here’s just one idea to consider. Over the past 140-years, the S&P-500 index has netted an average return of 9.2%. Between 2010 and 2020, however, those average returns have ballooned to mid-double-digits – to 13.6% annually. If you built a portfolio based on a selection of safe non-volatile S&P-500 listed stocks, and assume your returns are 10% a year, within 10-years you’d be more than a third of your way to funding a lavish overseas retirement lifestyle. There’s no stress. No arm-twisting sales pitches. No loose-sleep-at-night “secret” investment strategy. It’s amazing what a collection of dividend-paying, Blue-chip companies can do to make your overseas, affordable retirement dreams a reality.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

July 2024

Categories

All

|

Employment Resources |

Creating Income |

Most Read Pages |

Resources/Info |

|

Copyright 2022 by Retired Brains

|

Disclaimer: We do our best to ensure the information on RetiredBrains.com is accurate and updated at all times; however, we are unable to guarantee the accuracy of all information. We make every attempt to keep the content up to date and factual. For the most current and complete product/service details please verify with the merchant, product, issuer, or service directly via their website or during the buying or application process. Please be aware that RetiredBrains may have a financial relationship with some of the sites included on our Website. RetiredBrains.com may receive compensation if users choose to click on the links located on certain pages of this website and sales and/or leads are generated. If legal advice or other expert assistance is required, the services of competent professional persons should be sought.

RSS Feed

RSS Feed