|

Your estate refers to everything you own. It is what makes up your net worth. Some of the things that make up your estate include cash, financial securities, physical possessions, and real estate. What Is An Estate?The word estate mostly comes to mind when talking about farms and historic homes. However, it is a lot more than that legally. An estate is anything valuable that you own. It may include antique items, pieces of art, investments, insurance, and all other types of assets and entitlements. Legally, a person’s estate consists of their assets minus liabilities. The value of your estate is relevant when you declare bankruptcy and when you die. When a debtor declares bankruptcy, their estate will be assessed to determine debts that they can still pay. Bankruptcy proceedings are just as long and complicated as the hearings following death. When one dies, estate planning helps manage inheritance and the division of their estate. It is one of the most important types of financial planning in life. You create a will explaining your intentions regarding the division of your estate. Those who benefit from your assets are also known as beneficiaries. How Are Estates Formed?Most estates are formed through voluntary alienation. It is the process through which one willingly exchanges land. If, however, you exchange it against your desires, like in the event of bankruptcy, it is known as involuntary alienation. Estate planning has aided the creation of many estates. Therefore, preparing a will is very important. During estate planning, one takes everything they own into consideration. They decide what will happen to their estate in case of their death. If you die with no will, a descent will settle your estate. It is the process through which your state determines what will happen to your possessions. Are There Alternative Ways of Gaining an Estate?Apart from voluntary or involuntary alienation, there are a few other ways to gain estate.

Writing a WillWills are legal documents meant to give guidelines on how property will be handled following the death of the property owner. A will may also provide instructions regarding the custody of minor children. When writing your will, you can name your executor or trustee. They are responsible for ensuring that your will is executed.

Depending on your intentions, a trust may be created. It can go into effect while you are still alive (living trust) or after you die (testamentary trust.) Probate is the first step towards executing your will. After your death, the custodian of your will takes it to probate court or to the executor of the will. They have to do this within a specified period after your death. The probate process is overseen by the court. The goal is to prove the validity and authenticity of the will before it can be executed. When the process is completed, the court will officially appoint an executor. They can act on behalf of the deceased legally. If you have any questions or concerns regarding your estate, it would be best to seek the opinion of your lawyer as soon as possible.

0 Comments

Are you one of those folks who continually worries about affording life in retirement? Do you frequently fire-up your spreadsheets and plug in numbers from your latest retirement plan…only to learn you’re not quite there yet? Have you been convinced to make a timesharing commitment, as part of your “affordable retirement” strategy but wonder what impact that will have on your finances? Well, if you find yourself in any of these situations, then take (small!) comfort knowing that you’re not alone. Surprising Truth about Retirement AffordabilityMillions of people like you battle the eternal question: Am I retirement ready, and how do I retire comfortably with my nest egg? But guess what? Despite everything that your financial “advisor” may tell you – about needing a 7-figure nest egg to retire comfortably, you’ll be amazed at just even a moderate-sized nest egg can accomplish. If you think a 2-week time sharing arrangement will help ease the burden of your retirement plans, how about...

Strewn across the world, in safe, friendly jurisdictions, with agreeable climate and plenty of luxurious amenities, are retirement harbors where you can:

What Makes Overseas Retiring AttractivThe relative strength of your current savings means you’ll enjoy a much favorable parity between local currency and your home currency. Great climate. Friendly people. Affordable housing and healthcare. Combine all these together, and overseas is the perfect solution for an affordable retirement that’ll see your nest egg stretch farther than if you retired at “home”. Retirees in a high tax bracket at home may find overseas retirement especially attractive. If you choose a jurisdiction with a low-tax rate, which many of them are, or one with no tax at all, you’ll enjoy tax-free or tax-advantaged growth of your investments. That too enables retirees to stretch their nest egg farther than they could dream it would go if they retired at home. Unlocking Retirement CapitaYour first step in planning your overseas affordable retirement is to unlock all avenues of retirement capital. And, one of the greatest sources of that locked-in capital is an often-impulsive timesharing investment, brought about by aggressive, and often misleading sales pitches. Once invested, if they aren’t outright scams, timeshare companies often make it extremely challenging for investors to exit their fractional ownership. Often, it’s the eagerness to avoid this up-hill battle that then keeps investors tied to an investment that:

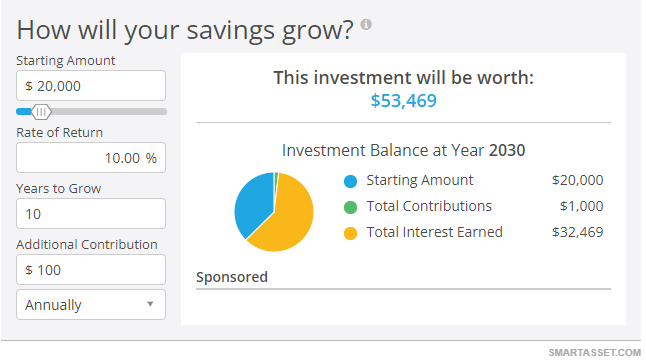

So, assuming you recover $20,000 from what you thought was a sunk investment. What could you do with those funds over a 10-year horizon until retirement? Well, the one thing that you shouldn’t do is invest in another timeshare! But here’s just one idea to consider. Over the past 140-years, the S&P-500 index has netted an average return of 9.2%. Between 2010 and 2020, however, those average returns have ballooned to mid-double-digits – to 13.6% annually. If you built a portfolio based on a selection of safe non-volatile S&P-500 listed stocks, and assume your returns are 10% a year, within 10-years you’d be more than a third of your way to funding a lavish overseas retirement lifestyle. There’s no stress. No arm-twisting sales pitches. No loose-sleep-at-night “secret” investment strategy. It’s amazing what a collection of dividend-paying, Blue-chip companies can do to make your overseas, affordable retirement dreams a reality.

Ageism is a commonplace problem that is only really just beginning to be acknowledged and addressed in organizations of all sizes. In many cases it is especially pernicious because it flies under the radar and means that older people are discriminated against without even realizing it. If you are keen to stamp out ageism in your business, knowing where to look for it and how to fight it is a good starting point, so here are some strategies to ensure that team members are treated with respect and enjoy equal opportunities, regardless of their age. Value and celebrate employees who are nearing retirementIt is undeniably important to demonstrate to employees that their contributions are valued by the company as a whole, and this is particularly crucial as retirement approaches and individuals may be reflecting on their many years of service. Planning a retirement party is a responsibility which should be taken seriously, since it will be the culmination of a team member’s career and should be a special occasion that showcases exactly what they mean to the firm that has been such a big part of their life for so long. There is definitely a sense in some corporate cultures that older members of staff are not as valuable as their younger counterparts, but you need to be proactive in dispelling this, and public recognition of achievements such as retirement parties set a positive example that others will follow. Offer training opportunitiesAnother vital weapon in the war on ageism is the unrestricted provision of training to employees of all ages and backgrounds. The temptation to write off older workers as being incapable of learning any new skills or even changing their professional discipline of choice entirely after they hit a certain landmark ages may be there, but this goes against research which shows that lifelong learning is hugely advantageous, especially in a business context. So this is not just about being attuned to the needs of individuals, but also recognizing that the business itself stands to benefit from providing training to older employees, which can even set them up for jobs post-retirement. Embrace experience to solve problemsProblem-solving is something which all businesses have to do to succeed, and with a multi-generational workforce at your disposal, you are actually in a much better position to overcome the challenges you face. While younger team members may be tech savvy enough to seek out digital solutions to pressing problems, older employees will be able to fall back on their long experience in their roles, and will also think about issues in a different way to their fresh faced peers. Being attuned to this reality should ensure that you not only accept that experience can breed wisdom, but also that it makes more sense to have teams made up of people of different ages, rather than skewing more towards one specific generation, regardless of which audience you are targeting. Make the most of mentoringLeading on from the idea that the experience of older employees is a good thing in a team working scenario, it should also be said that mentorship is another mutually beneficial option when you have employees from across the age spectrum. When veterans are paired with rookies, this is very much a two way street; the experience of the former can rub off on the latter, while older employees will also find their own careers bolstered because they are connecting with a new generation and will be building contacts in a legitimate and acceptable way, rather than having to be proactive about this themselves. Put inclusivity at the top of the agendaPerhaps the most subtle form of ageism in the business world comes about when older employees are excluded from certain events that their younger colleagues are able to attend.

This could be something as important as a meeting with a major client, or something as seemingly unremarkable as post-work drinks on a Friday evening. Whatever the case, managers and business leaders need to be aware of this and aim to ensure that everyone is included in such events equally, regardless of their seniority. It may take time and effort to reduce and eliminate ageism in the workplace, but it is very much a process worth pursuing, since it is one which we will ultimately all face. If you are thinking of visiting Scotland, don't wait any longer! Choose one of the Scotland tours you like the most, and let's find out what are the best cities to visit while in Scotland. 1. EdinburghEdinburgh is a perfect place to start acquaintance with Scotland due to its rich history that dates back to before Roman times. Visit the castle, walk around the Old Town, admire the beautiful Scottish architecture, and see the views of the stunning highlands. 2. St. AndrewsThe next city to visit is St. Andrews, renowned for being called the home of the world's golf. But this city has so much more to offer you. You can start exploring St. Andrews by visiting the ruins, which hold great historical, religious, and architectural significance. 3. OrkneyGet ready to be amazed by the dramatic and beautiful coastline, rocky beaches, and long stretches of sand in Orkney. And if you are lucky, you may even see whales. 4. InvernessInverness is another great city with a rich history that will fascinate you for sure. And the reason for that is not only picturesque landscapes but also the lake with the Loch Ness monster. And in case you don't get the chance to see it, you still will be lucky to catch a glimpse of all the beauty that the city offers. 5. GlasgowGlasgow is known for its friendly and pleasant atmosphere, world-class attractions, numerous music events, unique neighborhoods, and stunning architecture. Don’t miss out on the opportunity and explore the various sites of Glasgow 6. StirlingIf you want to dive deep into medieval times, then visiting Stirling is a must. In addition to its majestic fortresses and impressive castles, this city boasts some incredible churches. And what is more, you can find many fascinating legends and totally immerse yourself in those times. 7. AberdeenAberdeen has a long and fascinating history reflected on architecture, culture, and traditions. The city is perfect for exploring on foot, as everything here is nearby. Make sure to visit places like Johnston Gardens, Aberdeen Beach, Aberdeen Art Gallery, Maritime Museum, and others. 8. MelroseMelrose is known for being one of the most beautiful cities in Scotland. And exploring it is an excellent opportunity to travel back in time as Melrose has plenty of remarkable places that can teleport you, including Melrose Abbey, Dryburgh Abbey, Harmony Garden, and many more.

Have you ever thought about moving? Now that you’ve retired, it could be the perfect time to downsize. But why would you want to shed square footage? Check out these five reasons below. 1. You Fear the UnexpectedIf you had to replace your furnace suddenly or take your car into the shop for an unexpected repair, would you have the money handy? A new survey shows most people would have to borrow money for any unexpected expense that costs more than $1,000. Your retirement fund is off-limits, so you may have to take out a cash advance to help you handle unexpected repairs. Online cash advances offer borrowing options that aren't payday loans with quick and easy applications. If approved, you’ll receive funds that act like a safety net for emergencies. But as simple as these cash advances are, seniors living on a fixed income should think about how they can cover future unexpected expenses without borrowing. If it’s impossible with your current living expenses, downsizing could free up more cash to put toward emergency savings. 2. You Don’t Ever Use Some RoomsYou might have needed all four bedrooms, a den, and the basement in your younger days when all the kids still lived at home. But now that you’re an empty nester, you might not use these rooms as often anymore. It’s easy to forget that these spaces take money to heat, cool, and furnish. You can sell this unused furniture before you move, and you’ll save on utilities once you settle into a smaller space. A little extra money never hurt anyone; you can use it to pay off existing cash advances, bolster your savings, or have a bit of fun. 3. Getting Around is a StruggleYou might not be as spry as you once were. Everyone loses a little mobility as they age, but your physical limitations could be preventing you from enjoying your entire house and the surrounding property. If you’re finding it hard to climb stairs or walk around your garden, you should consider downsizing to a smaller, single-floor home or apartment. Making the switch could help you age in place without worrying about your safety or health. 4. You Can’t Keep Up with MaintenanceAnother sign you should move to a smaller place is if you’re having trouble cleaning or maintaining your current home. Few people enjoy doing any household chore, but dusting, gardening, or mowing the lawn can be even more challenging if you’re dealing with reduced mobility. Give yourself a break by downsizing. You won’t just shed square footage in the move. You’ll also cut your to-do list in half. 5. You Live Far Away from Loved OnesAfter more than a year living with a healthcare pandemic, isolation is a frustrating problem faced by seniors today. It’s made even worse when family and friends live a considerable car ride away. Connection to the people you love is essential at any age, but it’s even more important when you’re a senior. Having close friends, cousins, and grandchildren nearby boosts your mental health, and you’ll have someone nearby if you face an emergency. Is it Time to Downsize?Did any of the points made in this list resonate? Consider downsizing now that you’re retired — you stand to gain a lot in the move!

|

Archives

July 2024

Categories

All

|

Employment Resources |

Creating Income |

Most Read Pages |

Resources/Info |

|

Copyright 2022 by Retired Brains

|

Disclaimer: We do our best to ensure the information on RetiredBrains.com is accurate and updated at all times; however, we are unable to guarantee the accuracy of all information. We make every attempt to keep the content up to date and factual. For the most current and complete product/service details please verify with the merchant, product, issuer, or service directly via their website or during the buying or application process. Please be aware that RetiredBrains may have a financial relationship with some of the sites included on our Website. RetiredBrains.com may receive compensation if users choose to click on the links located on certain pages of this website and sales and/or leads are generated. If legal advice or other expert assistance is required, the services of competent professional persons should be sought.

RSS Feed

RSS Feed