Apply for Social Security

You should apply 3 months before you wish to start collecting.

The Social Security Administration now allows you to easily apply on line. When you’re finished,click the “Sign Now” button to submit your application. There are no forms to sign, and most of the time no additional documents are required, but to be safe have your Social Security card or a record of your birth like a birth certificate or proof of U.S. citizenship handy. If more information is needed, Social Security will contact you To apply, click here or call 1-800-772-1213.

To check your Social Security benefits you can create a personal account statement which will show you what your benefits are or will be. It will also show you a list of what your benefit contributions have been which you will be able to check for accuracy.

Go to http://www.socialsecurity.gov/myaccount/ to create your free personal online Social Security information site where you can keep track of your earnings and verify them every year and get an estimate of your future benefits if you are still working

Your normal retirement age (sometimes called your “full retirement age”) depends on your year of birth. Normal retirement age is the point at which you’re eligible for full Social Security retirement benefits.

To check your Social Security benefits you can create a personal account statement which will show you what your benefits are or will be. It will also show you a list of what your benefit contributions have been which you will be able to check for accuracy.

Go to http://www.socialsecurity.gov/myaccount/ to create your free personal online Social Security information site where you can keep track of your earnings and verify them every year and get an estimate of your future benefits if you are still working

Your normal retirement age (sometimes called your “full retirement age”) depends on your year of birth. Normal retirement age is the point at which you’re eligible for full Social Security retirement benefits.

|

1937 and prior -Age 65

1938 - 65 and 2 months 1939 - 65 and 4 months 1940 - 65 and 6 months 1941 - 65 and 8 months |

1942 - 65 and 10 months

1943 to 1954 - Age 66 1955 - 66 and 2 months 1956 - 66 and 4 months 1957 - 66 and 6 months |

1958 - 66 and 8 months

1959 - 66 and 10 months 1960 + Age 67 |

If you were born on January 1 of any year, look to the previous year in the table above to find your normal retirement age.

When should we elect to receive our Social Security benefits?

Retirees and those planning their retirement face a complex maze with their Social Security elections. An average couple must analyze many different choices to have any chance of maximizing their Social Security income during their retirement years.

Maximize your total Social Security receipts and select a plan that provides you with the monthly payments that are right for you.

To watch a video that will help you with your individualized, personal Social Security selection process. Click here

To clarify in order to receive Social Security benefits you must wait until your full retirement age (currently 66) to file and suspend benefits. If you decide to suspend benefits, during the suspension period you will accrue delayed retirement credits worth 8% per year up to the age of 70.

There is a strategy that will allow the main earner the ability to start Social Security benefits for her/his spouse while suspending his/her benefits until these benefits increase.

This is an excellent way for married couples to collect some benefits immediately and ensure that the higher earner collects an even larger benefit later. This also means that it is likely the surviving spouse will receive a larger benefit if the main breadwinner dies first. Survivor benefits are worth 100% of the deceased worker's benefit, including any delayed retirement credits.

This is a complicated area and it is suggested that delaying or suspending benefits and perhaps changing your mind because of different circumstances is a possibility, by all means consultant an experienced professional for advice.

Maximize your total Social Security receipts and select a plan that provides you with the monthly payments that are right for you.

To watch a video that will help you with your individualized, personal Social Security selection process. Click here

To clarify in order to receive Social Security benefits you must wait until your full retirement age (currently 66) to file and suspend benefits. If you decide to suspend benefits, during the suspension period you will accrue delayed retirement credits worth 8% per year up to the age of 70.

There is a strategy that will allow the main earner the ability to start Social Security benefits for her/his spouse while suspending his/her benefits until these benefits increase.

This is an excellent way for married couples to collect some benefits immediately and ensure that the higher earner collects an even larger benefit later. This also means that it is likely the surviving spouse will receive a larger benefit if the main breadwinner dies first. Survivor benefits are worth 100% of the deceased worker's benefit, including any delayed retirement credits.

This is a complicated area and it is suggested that delaying or suspending benefits and perhaps changing your mind because of different circumstances is a possibility, by all means consultant an experienced professional for advice.

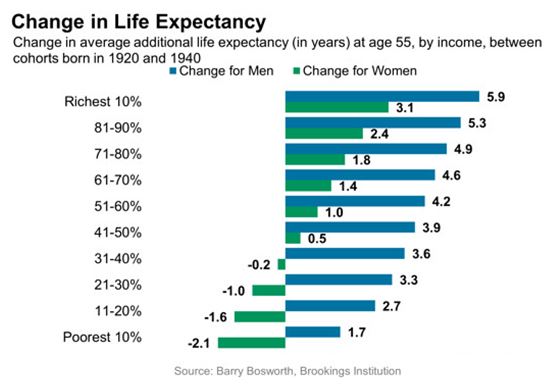

It turns out people at the bottom of this chart are not having an increase in life expectancy,

and they are getting a real reduction in Social Security benefits as a result as they are going to get Social Security payments for less years.

In this chart you can see that a wealthy man, born in 1920 who retired at age 65, could expect to draw Social Security for 19 years. His son, born in 1940 who retires at age 67, could expect to draw benefits for 24 years. He has actually retired later, but he’s living and drawing benefits longer.

This would not be true for men and women at the bottom income levels. They would draw Social Security for less years and as the retirement age rises (the age they are entitled to Social Security benefits) their longevity does not.

and they are getting a real reduction in Social Security benefits as a result as they are going to get Social Security payments for less years.

In this chart you can see that a wealthy man, born in 1920 who retired at age 65, could expect to draw Social Security for 19 years. His son, born in 1940 who retires at age 67, could expect to draw benefits for 24 years. He has actually retired later, but he’s living and drawing benefits longer.

This would not be true for men and women at the bottom income levels. They would draw Social Security for less years and as the retirement age rises (the age they are entitled to Social Security benefits) their longevity does not.

Delay benefits if at all possible.

First of all Social Security was never intended to be a pension you could live on. It was designed to supplement your income during retirement. In 2013 the average Social Security payment is $1,262 a month, according to the Social Security Administration That’s an annual income of $15,144.

Under current law, individuals don’t have to pay taxes on Social Security benefits if their total income is less than $25,000. For couples, the limit is $32,000. If you make more than that, however, you must pay income taxes on a portion of your benefits, and that portion rises as your income does.

If your income is $25,000 to $34,000 or you are a couple with income of $32,000 to $44,000 may have to pay taxes on half your SS benefits.

Individuals with income of more than $34,000 and couples with income of more than $44,000 may have to pay taxes on 85% of their benefits.

Under current law, individuals don’t have to pay taxes on Social Security benefits if their total income is less than $25,000. For couples, the limit is $32,000. If you make more than that, however, you must pay income taxes on a portion of your benefits, and that portion rises as your income does.

If your income is $25,000 to $34,000 or you are a couple with income of $32,000 to $44,000 may have to pay taxes on half your SS benefits.

Individuals with income of more than $34,000 and couples with income of more than $44,000 may have to pay taxes on 85% of their benefits.

Waiting to receive Social Security benefits can pay off.

If you retire at 62, you’ll receive about $750 a month, according to Social Security. Wait to 66, you’ll get $1,000. Wait until 70, you’ll get $1,320..

Unless it is likely you will not live the average longer projected life, if you are in your early 60s you should not tap into your Social Security benefits. By starting at 62, rather than at the government's "full retirement age" of 66 for people born from 1943 to 1954, you would cut your monthly benefits substantially. If you wait until age 70 you would get 132% of the monthly benefit you would collect at your full retirement age.

A retiree eligible for $18,750 a year in Social Security at age 62 who waits to collect would receive $33,000 a year starting at age 70 and could substantially increase the after-tax amount she/he could spend by age 95, according to T. Rowe Price. Assuming the benefit would increase 3% a year for inflation, and that the retiree was in the 25% marginal income-tax bracket, he/she would get $850,000 in all by starting the benefit at age 62—or $1.4 million by waiting until age 70.

Many Americans approaching retirement are not aware of the strategies that could have a significant impact on their retirement income. Most know that you can start collecting Social Security benefits at any time between age 62 and age 70. Most also know that if you wait you can expect to receive a larger monthly Social Security check. Unfortunately most Americans are not delaying taking Social Security to achieve this benefit.

If you are an average worker expected to live an average life expectancy you would do much better by delaying receiving Social Security until later years. If you end up living longer than the average, you come out ahead. Or course if you end up living less than the average age, delayed claiming would not be to your advantage.

For those who, are sick or need the money, taking benefits early could be the best option, but delaying claiming until as late as possible or until you need the money is usually the best strategy.

Delaying claiming Social Security also helps increase the monthly spousal benefit (assuming your spouse doesn't have a higher benefit based on her/his own work record.

If your full retirement age is older than 65 (that is, you were born after 1937), you still will be able to take your benefits at age 62, but the reduction in your benefit amount will be greater than it is for people retiring now.

Here's how it works if your full retirement age is 67.

If you start your retirement benefits at age 62, your monthly benefit amount is reduced by about 30 percent. The reduction for starting benefits at age

63 is about 25 percent;

64 is about 20 percent;

65 is about 13.3 percent; and

66 is about 6.7 percent.

If you start receiving spouse's benefits at age 62, your monthly benefit amount is reduced to about 32.5 percent of the amount your spouse would receive if his or her benefits started at full retirement age. (The reduction is about 67.5 percent.) The reduction for starting benefits as a spouse at age

63 is about 65 percent;

64 is about 62.5 percent;

65 is about 58.3 percent;

66 is about 54.2 percent; and

67 is 50 percent (the maximum benefit amount).

For more information go to http://www.ssa.gov/retire2/retirechart.htm

Unless it is likely you will not live the average longer projected life, if you are in your early 60s you should not tap into your Social Security benefits. By starting at 62, rather than at the government's "full retirement age" of 66 for people born from 1943 to 1954, you would cut your monthly benefits substantially. If you wait until age 70 you would get 132% of the monthly benefit you would collect at your full retirement age.

A retiree eligible for $18,750 a year in Social Security at age 62 who waits to collect would receive $33,000 a year starting at age 70 and could substantially increase the after-tax amount she/he could spend by age 95, according to T. Rowe Price. Assuming the benefit would increase 3% a year for inflation, and that the retiree was in the 25% marginal income-tax bracket, he/she would get $850,000 in all by starting the benefit at age 62—or $1.4 million by waiting until age 70.

Many Americans approaching retirement are not aware of the strategies that could have a significant impact on their retirement income. Most know that you can start collecting Social Security benefits at any time between age 62 and age 70. Most also know that if you wait you can expect to receive a larger monthly Social Security check. Unfortunately most Americans are not delaying taking Social Security to achieve this benefit.

If you are an average worker expected to live an average life expectancy you would do much better by delaying receiving Social Security until later years. If you end up living longer than the average, you come out ahead. Or course if you end up living less than the average age, delayed claiming would not be to your advantage.

For those who, are sick or need the money, taking benefits early could be the best option, but delaying claiming until as late as possible or until you need the money is usually the best strategy.

Delaying claiming Social Security also helps increase the monthly spousal benefit (assuming your spouse doesn't have a higher benefit based on her/his own work record.

If your full retirement age is older than 65 (that is, you were born after 1937), you still will be able to take your benefits at age 62, but the reduction in your benefit amount will be greater than it is for people retiring now.

Here's how it works if your full retirement age is 67.

If you start your retirement benefits at age 62, your monthly benefit amount is reduced by about 30 percent. The reduction for starting benefits at age

63 is about 25 percent;

64 is about 20 percent;

65 is about 13.3 percent; and

66 is about 6.7 percent.

If you start receiving spouse's benefits at age 62, your monthly benefit amount is reduced to about 32.5 percent of the amount your spouse would receive if his or her benefits started at full retirement age. (The reduction is about 67.5 percent.) The reduction for starting benefits as a spouse at age

63 is about 65 percent;

64 is about 62.5 percent;

65 is about 58.3 percent;

66 is about 54.2 percent; and

67 is 50 percent (the maximum benefit amount).

For more information go to http://www.ssa.gov/retire2/retirechart.htm

Do I have to pay into Social Security if I start working again after receiving Social Security benefits?

Yes. You must pay Social Security taxes: 6.2% of your earnings on wages up to a cutoff of $117,000 in 2014. If you are beyond your full retirement age of 66 working will not reduce your benefits. For those who work prior to their full retirement age, benefits would be cut $1 for every $2 dollars earned over an exempted amount.

If your earnings are substantial your new work could boost your future benefits since they are based the top 35 years of earnings.

Disclaimer: As with all financial advice you would check with your accountant and attorney to verify if this information pertains to your individual situation.

If your earnings are substantial your new work could boost your future benefits since they are based the top 35 years of earnings.

Disclaimer: As with all financial advice you would check with your accountant and attorney to verify if this information pertains to your individual situation.

When to Apply for Social Security

Full retirement age for Social Security benefits is gradually increasing to age 67. If you were born between 1943 and 1954, you should think carefully before deciding to take early retirement as the age for receiving Social Security is 66. People born in 1960 or later reach full retirement age at 67. Early retirement will be more costly for both of these age groups. If you were born during these years you will see your Social Security benefit reduced by 25% if you elect to retire at age 62. People born in 1937 or earlier have been able to retire at 62 with only a 20% reduction. Anyone born in 1960 and later will face a 30% reduction. No matter what your full retirement age is, you may start receiving benefits as early as age 62.

You can also retire at any time between age 62 and full retirement age. However, if you start at one of these early ages, your benefits are reduced a fraction of a percent for each month before your full retirement age. Social Security tool: http://www.ssa.gov/planners/calculators.htm

Enter your age and current income and the site will give you a ballpark monthly benefits estimate for early, regular or delayed retirement as well as estimated disability and survivor benefits.

The Social Security Web http://www.ssa.gov/ gives all kinds of worthwhile information including:

You can also retire at any time between age 62 and full retirement age. However, if you start at one of these early ages, your benefits are reduced a fraction of a percent for each month before your full retirement age. Social Security tool: http://www.ssa.gov/planners/calculators.htm

Enter your age and current income and the site will give you a ballpark monthly benefits estimate for early, regular or delayed retirement as well as estimated disability and survivor benefits.

The Social Security Web http://www.ssa.gov/ gives all kinds of worthwhile information including:

- Calculating your benefits

- How to apply for social security benefits and disability benefits

- Retirement planning information

- Marriage, divorce, name change

- Death in the family

- Ability to download forms

- Order or view publications

- Sign up for a free electronic newsletter on social security matters

When should you start collecting Social Security?

If you postpone drawing a Social Security retirement benefit, you’ll end up collecting more money each month. Let’s look at some actual numbers.

Here are examples assuming you would receive a monthly benefit of $1,000 a month had you waited to start collecting until your full retirement age of 66.

Start collecting at age 62 and you’ll receive $750 a month

Start collecting at 63 instead, you’ll get $800 a month.

Start collecting at 64, you’ll receive $866 a month.

Start collecting at 65, you’ll get $933 a month.

Start collecting at 66 — full retirement age — and you’ll receive the full $1,000 a month.

Start collecting at 67, you’ll receive $1,080 a month — an 8% increase.Start collecting at 68, you’ll receive $1,160 a month.

Start collecting at 69, you’ll receive $1,240 a month.

Start collecting at 70, you’ll receive $1,320 a month — which is 32% more than if you started drawing benefits at age 66.

Here are examples assuming you would receive a monthly benefit of $1,000 a month had you waited to start collecting until your full retirement age of 66.

Start collecting at age 62 and you’ll receive $750 a month

Start collecting at 63 instead, you’ll get $800 a month.

Start collecting at 64, you’ll receive $866 a month.

Start collecting at 65, you’ll get $933 a month.

Start collecting at 66 — full retirement age — and you’ll receive the full $1,000 a month.

Start collecting at 67, you’ll receive $1,080 a month — an 8% increase.Start collecting at 68, you’ll receive $1,160 a month.

Start collecting at 69, you’ll receive $1,240 a month.

Start collecting at 70, you’ll receive $1,320 a month — which is 32% more than if you started drawing benefits at age 66.

How to apply for Social Security disability benefits

Social Security defines disability as "the inability to engage in any substantial gainful activity by reason of any medically determined physical or mental impairment which can be expected to result in death, or which has lasted or is expected to last for a continuous period of not less than 12 months."

According to the Social Security Administration Americans have a 30% probability of becoming disabled prior to retirement age.

Social Security can provide assistance to you, your spouse and your children. Even if you do not have sufficient work credits to qualify on your own you may be entitled to benefits as a disabled widow or widower or a deceased worker or as a disabled child of a worker who is retired, disabled or deceased.

To receive disability payments you must meet both work requirements and medical requirements.

State government make the determination whether a person is disabled and this determination is based on reports on her/his medical condition, medical records and both vocational and educational background.

Social Security makes the rules, trains state evaluators and conducts reviews to ensure compliance.

Work requirements vary with the age at the time of disability as well as when work credits were earned.

For example, claimants 31 and older would need between 20 and 40 credits, (20 earned within the last 10 years)

Younger workers can apply with fewer credits.

According to the Social Security Administration Americans have a 30% probability of becoming disabled prior to retirement age.

Social Security can provide assistance to you, your spouse and your children. Even if you do not have sufficient work credits to qualify on your own you may be entitled to benefits as a disabled widow or widower or a deceased worker or as a disabled child of a worker who is retired, disabled or deceased.

To receive disability payments you must meet both work requirements and medical requirements.

State government make the determination whether a person is disabled and this determination is based on reports on her/his medical condition, medical records and both vocational and educational background.

Social Security makes the rules, trains state evaluators and conducts reviews to ensure compliance.

Work requirements vary with the age at the time of disability as well as when work credits were earned.

For example, claimants 31 and older would need between 20 and 40 credits, (20 earned within the last 10 years)

Younger workers can apply with fewer credits.

You can apply by calling Social Security at (800) 772-1213 or by making an appointment with your local Social Security Office

Applying for Social Security disability and SSI disability benefits can be difficult.

This site provides information that is typically difficult to get from the representative taking your claim for SSD and SSI benefits.

Here you can also find a qualified disability attorney in your state to assist you should your claim be denied or you need legal help.

Go to Social Security Disability Information

This site provides information that is typically difficult to get from the representative taking your claim for SSD and SSI benefits.

Here you can also find a qualified disability attorney in your state to assist you should your claim be denied or you need legal help.

Go to Social Security Disability Information