When Should You Receive Social Security?

If you postpone drawing a Social Security retirement benefit, you’ll end up collecting more money each month.

Remember that Social Security was never intended to be a pension you could live on. It was designed to supplement your income during retirement.

Remember that Social Security was never intended to be a pension you could live on. It was designed to supplement your income during retirement.

Government site where you can enter your information to see your estimated benefits before you claim

The age you claim Social Security affects your lifetime income. This site will help you think through this decision. You can explore how your claiming age affects your Social Security retirement benefits. You can enter your date of birth and highest annual work income and the site will show you your estimated benefits on a year to year payout basis plus total benefits depending in how long you live.Go to http://www.consumerfinance.gov/retirement/before-you-claim/

Is it fair to try and game the system like this? Yes. More knowledge creates more fairness. There are hundreds of thousands of social security rules, and it’s not fair if only those who have the resources to understand them get maximum benefits.

Is it fair to try and game the system like this? Yes. More knowledge creates more fairness. There are hundreds of thousands of social security rules, and it’s not fair if only those who have the resources to understand them get maximum benefits.

Waiting to receive Social Security benefits can pay off

Delay benefits if at all possible

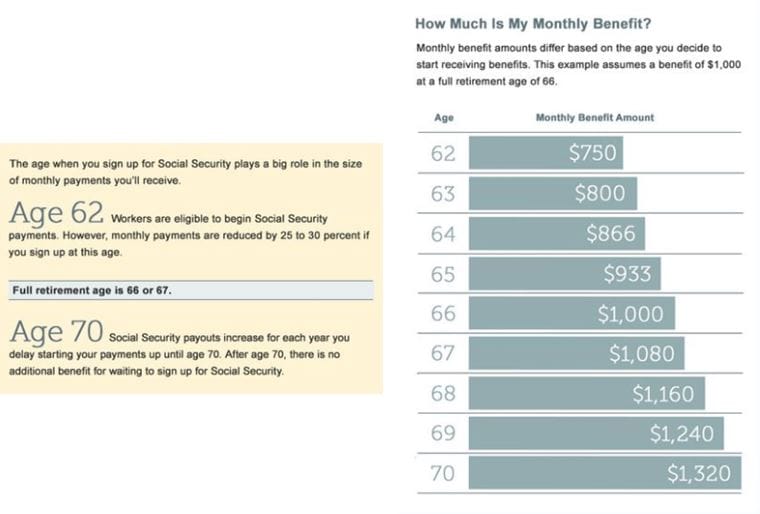

Unless it is likely you will not live the average longer projected life, if you are in your early 60s you should not tap into your Social Security benefits. By starting at 62, rather than at the government's "full retirement age" of 66 for people born from 1943 to 1954, you would cut your monthly benefits substantially. If you wait until age 70 you would get 132% of the monthly benefit you would collect at your full retirement age.

A retiree eligible for $18,750 a year in Social Security at age 62 who waits to collect would receive $33,000 a year starting at age 70 and could substantially increase the after-tax amount she/he could spend by age 95, according to T. Rowe Price. Assuming the benefit would increase 3% a year for inflation, and that the retiree was in the 25% marginal income-tax bracket, he/she would get $850,000 in all by starting the benefit at age 62—or $1.4 million by waiting until age 70.

Many Americans approaching retirement are not aware of the strategies that could have a significant impact on their retirement income. Most know that you can start collecting Social Security benefits at any time between age 62 and age 70. Most also know that if you wait you can expect to receive a larger monthly Social Security check. Unfortunately most Americans are not delaying taking Social Security to achieve this benefit.

A retiree eligible for $18,750 a year in Social Security at age 62 who waits to collect would receive $33,000 a year starting at age 70 and could substantially increase the after-tax amount she/he could spend by age 95, according to T. Rowe Price. Assuming the benefit would increase 3% a year for inflation, and that the retiree was in the 25% marginal income-tax bracket, he/she would get $850,000 in all by starting the benefit at age 62—or $1.4 million by waiting until age 70.

Many Americans approaching retirement are not aware of the strategies that could have a significant impact on their retirement income. Most know that you can start collecting Social Security benefits at any time between age 62 and age 70. Most also know that if you wait you can expect to receive a larger monthly Social Security check. Unfortunately most Americans are not delaying taking Social Security to achieve this benefit.

If you are an average worker expected to live an average life expectancy...

you would do much better by delaying receiving Social Security until later years. If you end up living longer than the average, you come out ahead. Or course if you end up living less than the average age, delayed claiming would not be to your advantage.

For those who, are sick or need the money...

taking benefits early could be the best option, but delaying claiming until as late as possible or until you need the money is usually the best strategy. Delaying claiming Social Security also helps increase the monthly spousal benefit (assuming your spouse doesn't have a higher benefit based on her/his own work record.

If your full retirement age is older than 65...

(that is, you were born after 1937), you still will be able to take your benefits at age 62, but the reduction in your benefit amount will be greater than it is for people retiring now.

How it works if your full retirement age is 67

If you start your retirement benefits at age 62, your monthly benefit amount is reduced by about 30 percent. The reduction for starting benefits at age

- 63 is about 25 percent;

- 64 is about 20 percent;

- 65 is about 13.3 percent; and

- 66 is about 6.7 percent

If you start receiving spouse's benefits at age 62

Your monthly benefit amount is reduced to about 32.5 percent of the amount your spouse would receive if his or her benefits started at full retirement age. (The reduction is about 67.5 percent.) The reduction for starting benefits as a spouse at age

To use the Life Expectancy Calculator click here

- 63 is about 65 percent;

- 64 is about 62.5 percent;

- 65 is about 58.3 percent;

- 66 is about 54.2 percent; and

- 67 is 50 percent (the maximum benefit amount)

To use the Life Expectancy Calculator click here

Social Security Benefit Estimator

If you have signed up for Medicare but not for Social Security there is a retirement estimator on the Social Security Website which can provide immediate and personalized benefit estimates. To use this calculator click here.

You can also access tables which will show how much your benefits will be reduced with different choices www.ssa.gov/retire2/agereduction.htm You can start receiving benefits any time between the age of 62 and 70; however the earlier you select to receive your benefits the less your monthly payment will be.

Social Security Longevity Calculator

This calculator will show you the average number of additional years a person can expect to live, based only on the gender and date of birth you enter. Click here to reach the calculator

Disclaimer: As with all financial advice you would check with your accountant and attorney to verify if this information pertains to your individual situation.

To access your Social Security statement of benefits create a “My Social Security Account” on the Social Security website

http://socialsecurity.gov/myaccount/

You can also access tables which will show how much your benefits will be reduced with different choices www.ssa.gov/retire2/agereduction.htm You can start receiving benefits any time between the age of 62 and 70; however the earlier you select to receive your benefits the less your monthly payment will be.

Social Security Longevity Calculator

This calculator will show you the average number of additional years a person can expect to live, based only on the gender and date of birth you enter. Click here to reach the calculator

Disclaimer: As with all financial advice you would check with your accountant and attorney to verify if this information pertains to your individual situation.

To access your Social Security statement of benefits create a “My Social Security Account” on the Social Security website

http://socialsecurity.gov/myaccount/