|

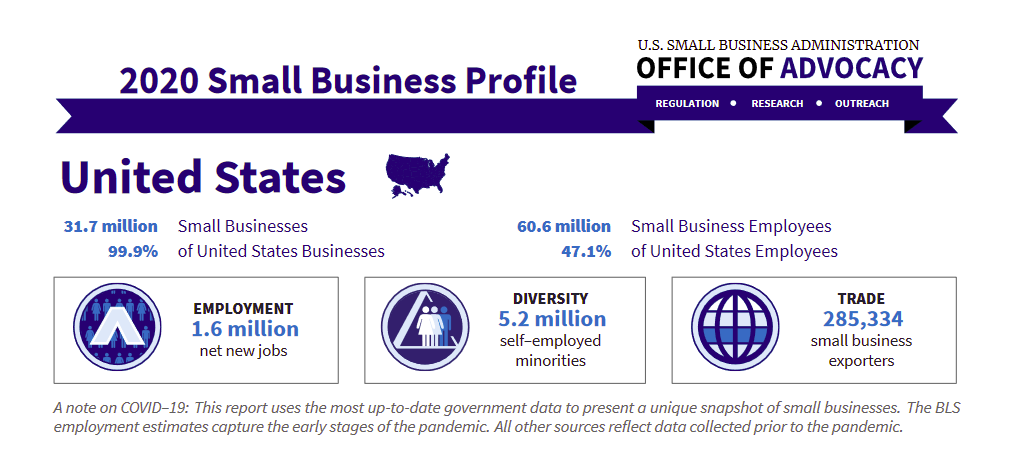

Times are challenging for all consumers, especially for small business owners. Nowadays, people have cut their spending to necessities while many consumers have been laid off with small businesses being shut. The new economic crisis made thousands of entrepreneurs seek additional financial assistance to help their ventures remain monetary afloat in such tough times. Small enterprises are the ones being affected the most by the current pandemic. While consumption habits have already changed, below are some available funding options and grants from the government and the private sector. The Impact on Small BusinessesThousands of small ventures have been negatively affected by the current pandemic. People are trying to lower their expenses so that entertainment, going out, and traveling costs aren’t on their spending list anymore. While people are learning to become more frugal, it has impacted small business owners who don’t have profit now. Many businesses have already been closed but the majority of them are still trying to survive. Regular consumers have also lost their jobs with women being the most vulnerable stratum of the population. It’s not easy to keep on paying salaries to your employees, pay the monthly bills, or cover the rent payments when you have no income. Many entrepreneurs need to renew their business model and rethink new ways of building their companies. There are many grants available to consumers today which may assist your business and help it stay afloat until the situation becomes more stable again. There is a variety of grants, so you may have a closer look and select the most suitable option. We are going to tell you about the best offers and assistance programs. Interesting fact: Last year, the number of small businesses in the U.S. reached 31,7 million! American Rescue Plan ActYou can find information about COVID-19 relief options offered by the US Small Business Administration. There are several grants available for consumers and small business owners for the period of the pandemic. Also, you may look through the American Rescue plan Act signed into law by President Biden. It was signed in March 2021 allowing entrepreneurs to obtain additional funds from the government including $7.25 billion for the Paycheck Protection Program. Industry-oriented grants allow restaurant owners to qualify for $28.6 billion from the Restaurant Revitalization Fund. Such pandemic relief grants and assistance programs are designed to help small business owners survive during the quarantine. The only drawback of such government-issued programs and grants is that they require lots of paperwork. So, they are quite time-consuming for the borrowers. If you value your time and don’t want to waste it on submitting multiple documents and applications, you may opt for alternative assistance programs and small business loans from online creditors. Alternative lending solutions are also popular today as they let common consumers and even unemployed people obtain urgent monetary aid. For instance, 2500 loan bad credit is widespread among those who have lost their jobs or simply need urgent money. While entrepreneurs may apply for special grants and programs from the government, unemployed mothers and parents may also qualify for financial assistance from alternative lending services. Such small loans are meant to support their needs during challenging times and help them fund their daily needs until they find a suitable job again. Top Government Grants and Assistance ProgramsThe above-mentioned government website offers a wide choice of grants and assistance programs for small businesses in different industries. The money flows straight from the federal government to ventures.

Certain funding is divided between local and state governments, not-for-profit organizations, etc. So, you may choose between various options and apply on the state or local level. Here are some of the most popular grants available today:

All in all, there are many funding grants and assistance programs available today for small business owners. Take some time to review the most popular funding options and select the one that meets your current financial needs. Depending on several qualifying factors, you may either get approved for one of these government-issued grants or apply for a small business loan from alternative creditors. Such funding options are designed to help entrepreneurs support their business needs during an economic crisis.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

July 2024

Categories

All

|

Employment Resources |

Creating Income |

Most Read Pages |

Resources/Info |

|

Copyright 2022 by Retired Brains

|

Disclaimer: We do our best to ensure the information on RetiredBrains.com is accurate and updated at all times; however, we are unable to guarantee the accuracy of all information. We make every attempt to keep the content up to date and factual. For the most current and complete product/service details please verify with the merchant, product, issuer, or service directly via their website or during the buying or application process. Please be aware that RetiredBrains may have a financial relationship with some of the sites included on our Website. RetiredBrains.com may receive compensation if users choose to click on the links located on certain pages of this website and sales and/or leads are generated. If legal advice or other expert assistance is required, the services of competent professional persons should be sought.

RSS Feed

RSS Feed