|

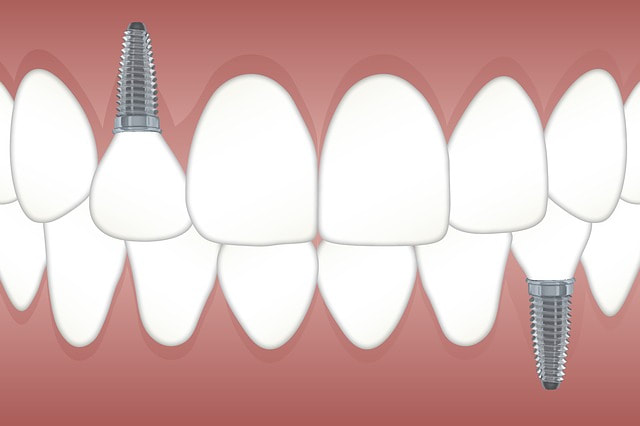

Insurance is an important facet of day-to-day living in the modern world, especially when you’re over the age of 60. That’s because, as you progress into retirement age, your bodily functions start to wane, which can open you up to a lot of situations whereby you may need insurance to protect yourself financially. With that said, here are 5 important types of insurance to consider when you retire; Travel InsuranceWith a free schedule and little to do in your retirement years, taking vacations, exploring landmarks in places you've always wanted to visit, or just enjoying the ambiance of a country is not a bad idea. But with everything comes its risks, and investing in travel insurance would go a long way in making a trip risk-free. Travel insurance suits fun-seekers or vacationers who just want to relax. Most policies cover inconveniences like flight or hotel cancellation, lost or stolen luggage, and even slight medical issues that might require a hospital visit during the trip. It’s important to avoid a senior insurance scam when trying to get travel insurance - that’s because seniors tend to be targets of scam attacks by fraudsters looking to take advantage of your desire to seek out insurance. Dental InsuranceDental insurance policies for retirees help in budgeting the maintenance of oral care. The policy can come as a standalone or included in a medical plan. This covers issues relating to the teeth, gum, and also preventive measures. Most insurance companies adopt the 100/80/50 payment structure which states the company covers 100% for preventive measures like cleaning the teeth and X-rays, 80% for basic procedures that include treating gum diseases or getting fillings; and 50% for major procedures like surgeries, inlays, and dentures. A great place to seek out dental insurance coverage is dentalinsurance.com. They’re a service that displays various dental insurance plans while also allowing you to compare and choose the one that fits your budget. Lifetime AnnuitiesA lifetime annuity is an income based plan for retirees. It gives the security of a steady allowance each month until they pass away. Unlike other retirement plans such as an IRA or a 401k which are heavily dependent on the state of the economy - lifetime annuities can offer retirees guaranteed income regardless of any economic downturns or stock market crashes. Lifetime annuities vary differently from life insurance in the payment aspect, in the sense that life insurance payment is paid out after the demise of its holder, while lifetime annuities are paid out in perpetuity while its holder is alive. Vision InsuranceVision Insurance for retirees is usually attached to health insurance, but can also be a standalone plan. It’s designed to handle the costs of eye checkups, prescribed eyeglasses, and contact lenses for its policyholders. The care providers give ranges from discounts on lenses or frames to covering partly for any laser eye surgery. With the insured only able to use the approved care by the provider. Health InsuranceHealth insurance is a contract issued by an insurance company that pays for the medical bills, surgeries, and drugs on behalf of its policyholder.

Acquiring health insurance is a relatively straightforward process, however, some issues can arise while selecting a plan to run with. For instance, most of the plans come with rules that may act as a barrier for getting another healthcare in the future. Some of these include being unable to use another service aside from the designated one by the provider and refusing to honor service payments when the service is obtained without proper approval. Most health insurance plans typically have a program especially made for retirees. While others not offered can be gotten through programs, qualifications, or direct purchase through the healthcare insurance marketplace.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

July 2024

Categories

All

|

Employment Resources |

Creating Income |

Most Read Pages |

Resources/Info |

|

Copyright 2022 by Retired Brains

|

Disclaimer: We do our best to ensure the information on RetiredBrains.com is accurate and updated at all times; however, we are unable to guarantee the accuracy of all information. We make every attempt to keep the content up to date and factual. For the most current and complete product/service details please verify with the merchant, product, issuer, or service directly via their website or during the buying or application process. Please be aware that RetiredBrains may have a financial relationship with some of the sites included on our Website. RetiredBrains.com may receive compensation if users choose to click on the links located on certain pages of this website and sales and/or leads are generated. If legal advice or other expert assistance is required, the services of competent professional persons should be sought.

RSS Feed

RSS Feed