|

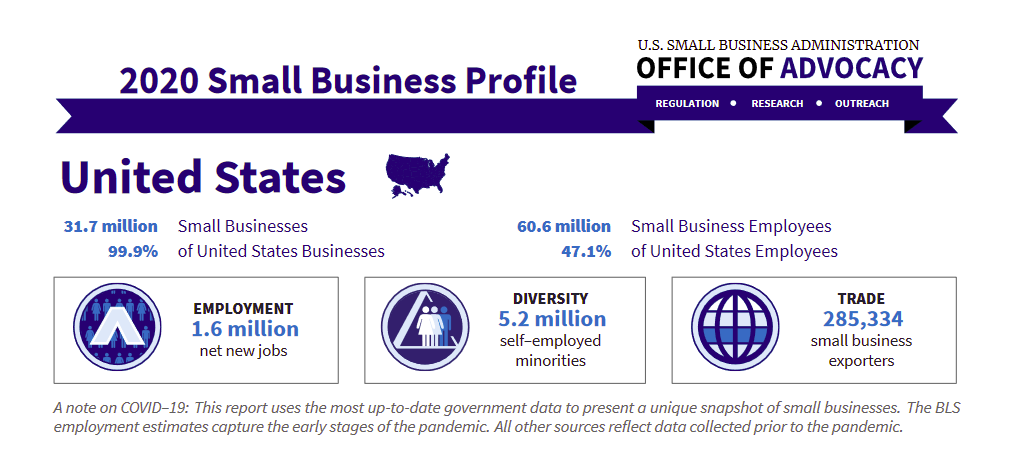

Times are challenging for all consumers, especially for small business owners. Nowadays, people have cut their spending to necessities while many consumers have been laid off with small businesses being shut. The new economic crisis made thousands of entrepreneurs seek additional financial assistance to help their ventures remain monetary afloat in such tough times. Small enterprises are the ones being affected the most by the current pandemic. While consumption habits have already changed, below are some available funding options and grants from the government and the private sector. The Impact on Small BusinessesThousands of small ventures have been negatively affected by the current pandemic. People are trying to lower their expenses so that entertainment, going out, and traveling costs aren’t on their spending list anymore. While people are learning to become more frugal, it has impacted small business owners who don’t have profit now. Many businesses have already been closed but the majority of them are still trying to survive. Regular consumers have also lost their jobs with women being the most vulnerable stratum of the population. It’s not easy to keep on paying salaries to your employees, pay the monthly bills, or cover the rent payments when you have no income. Many entrepreneurs need to renew their business model and rethink new ways of building their companies. There are many grants available to consumers today which may assist your business and help it stay afloat until the situation becomes more stable again. There is a variety of grants, so you may have a closer look and select the most suitable option. We are going to tell you about the best offers and assistance programs. Interesting fact: Last year, the number of small businesses in the U.S. reached 31,7 million! American Rescue Plan ActYou can find information about COVID-19 relief options offered by the US Small Business Administration. There are several grants available for consumers and small business owners for the period of the pandemic. Also, you may look through the American Rescue plan Act signed into law by President Biden. It was signed in March 2021 allowing entrepreneurs to obtain additional funds from the government including $7.25 billion for the Paycheck Protection Program. Industry-oriented grants allow restaurant owners to qualify for $28.6 billion from the Restaurant Revitalization Fund. Such pandemic relief grants and assistance programs are designed to help small business owners survive during the quarantine. The only drawback of such government-issued programs and grants is that they require lots of paperwork. So, they are quite time-consuming for the borrowers. If you value your time and don’t want to waste it on submitting multiple documents and applications, you may opt for alternative assistance programs and small business loans from online creditors. Alternative lending solutions are also popular today as they let common consumers and even unemployed people obtain urgent monetary aid. For instance, 2500 loan bad credit is widespread among those who have lost their jobs or simply need urgent money. While entrepreneurs may apply for special grants and programs from the government, unemployed mothers and parents may also qualify for financial assistance from alternative lending services. Such small loans are meant to support their needs during challenging times and help them fund their daily needs until they find a suitable job again. Top Government Grants and Assistance ProgramsThe above-mentioned government website offers a wide choice of grants and assistance programs for small businesses in different industries. The money flows straight from the federal government to ventures.

Certain funding is divided between local and state governments, not-for-profit organizations, etc. So, you may choose between various options and apply on the state or local level. Here are some of the most popular grants available today:

All in all, there are many funding grants and assistance programs available today for small business owners. Take some time to review the most popular funding options and select the one that meets your current financial needs. Depending on several qualifying factors, you may either get approved for one of these government-issued grants or apply for a small business loan from alternative creditors. Such funding options are designed to help entrepreneurs support their business needs during an economic crisis.

0 Comments

Even with the life settlement industry growing steadily, with a market value of billions of dollars, several myths about it and life settlements in general persist. These two myths are the “it’s not worth it” myth and the “it’s not safe, you’ll get ripped off” myth.

More specifically, these myths can be true in some life settlement engagements and situations, but painting the whole life settlement industry with such a brush and dismissing life settlements as a possibility means that you might be leaving a lot of money on the table. Life settlements can be a lucrative source of immediate cash for retirement and just as safe as when dealing with established financial institutions – there are just a few things you need to remember and take into account when considering selling your life insurance policy. First of all, due to their relative obscurity, financial advisors still tend to think of life settlements as something not worth exploring. That is if those financial advisors are familiar with life settlements at all. They may be dismissive of the idea, saying that it has nothing to offer that “simpler,” more “reliable” financial deals don’t have. These are misinformed opinions which can keep you from making a large amount of money from the sale of your unneeded or unwanted life insurance policy. Every year, more than $100 billion in life insurance face value lapses because policy owners don’t know that they can sell their policies, or are talked out of it by well‐meaning people who don’t know any better. On average, according to the Life Insurance Settlement Association (LISA), policyholders receive from four to seven times more through a life settlement than the amount offered by their insurance companies as the cash surrender value of their policy. That means that more than $100 billion is being forfeited to insurance companies every year. Life insurance is an asset like any other that can be liquidated and put to better use to improve the life of the policyholder immediately. That is the key takeaway when weigh ng up whether selling your life insurance policy is right for you – doing your research and comparing offers before you decide to go forward is critically important to get a good deal. The second misconception about the life settlement industry is that it is unsafe and unregulated. This is a holdover from the early days of the viatical and life settlement industries when regulations were indeed laxer, and unethical brokers took advantage of desperate people to make money for themselves. Nowadays, however, the industry is highly regulated in almost all US states and is represented by national and international associations of those involved that strive to educate and self‐regulate. Out of the 50 US states, life settlements are regulated in 42 of them as well as in Puerto Rico. This provides more than 90% of the US population with judicial protection when dealing with life settlements. Of course, precautions should be taken to ensure as smooth a transaction as possible. Different people have different worries about life settlements. Some are worried about their personal information, such as medical records, being shared or sold by the life expectancy underwriters or buyers of the policy to other third parties. Others are concerned about receiving the money, or hidden brokerage fees. For all of these concerns, the answer is the same: do your due diligence and defend your interests. This means discussing with a broker and potential buyer of your life insurance policy who will have access to your medical records. It means making sure that the full payment amount is placed in escrow before the transfer of the policy to the new owner. It means making sure that the broker you use lays out all their fees or the commission they take on a successful deal. And it means getting all of the above‐mentioned things in writing. Once you have the documents and contracts drawn up, you will be protected by laws both general and industry‐specific. The main thing to worry about is negotiating as good a deal as possible for yourself, as the “Wild West” days of the industry are over. In conclusion, life settlements often are – for the seniors who know about and take advantage of them – lucrative financial engagements that take place within an industry that is highly regulated in the overwhelming majority of the United States. Dismissing them out of hand as bad deals taking place in a shady industry is an attitude better left out of the analysis of your financial situation and what you can do to improve it. When done right, life settlements can be a great way to liquidate a life insurance policy you don’t need or want anymore and receive a handsome sum of cash in return – cash that you can use to boost your quality of life, pay off debts, or fund other assets. Finding the best retirement plan to suit your needs can be a tricky task. After all, your life after retirement is completely dependent on this decision! Ultimately, in order to find the best retirement plan for you, you must decide whether you want to undertake a private pension scheme, pension from the government, a workplace pension or a personal and stakeholder pension. Whilst Wizzcash loans might be able to help you if you encounter a financial emergency while you are still working, if you are retired, then you may have to turn to an alternative option. There are several tips that you can take into consideration as you begin to save for your retirement. Discover how to find the best retirement plan for you below. Planning Your Retirement IncomeWhen it comes to finding the best retirement plan, it is paramount that you understand the options available to you and what they include. The main types include:

What To Consider When Choosing The Best Retirement Plan For YouYour Earnings Ultimately, the first step to finding the right retirement plan is to consider your earnings. It is paramount that you carefully plan your retirement income as it is one of the most effective ways to save money for later in your life. Overall, you may be able to attain:

You must identify how much money you will need when you retire, because you may discover that you need more money than the State Pension offers. When Do You Want To Pay Taxes? Understandably, nobody wants to pay taxes, but unfortunately, we have no choice. Luckily for you, when it comes to your retirement savings, you do in fact get to choose when you pay them. Ultimately, this is one of the major differences between two key types of retirement plans. If you opt for a traditional retirement plan, you might be able to qualify for a tax deduction regarding the volume of your contributions. However, when the time comes to withdraw the money in retirement, it will be taxable, just like normal income. With this in mind, some forms of contributions however aren’t conclusive, but when you withdraw the money in retirement, it will be 100% tax-free. Ultimately, when it comes to finding the best retirement plan for you, you must consider when you would favour a tax break more. Will You Need The Money Right Away? When it comes to finding the best retirement plan for you, it is paramount to consider whether you will need to access the money right away. This is because with pre-tax retirement plans, such as the traditional retirement plan, you are required to start taking distributions after the Stage Pension age. Essentially, this means that once you reach this age, you will have to withdraw an unquestionable percentage of your account’s value per year. With other retirement plans however, this is not a set requirement, and you can keep the money in your account for as long as you wish. Working Past State Pension Age When you reach State Pension age, you may decide that you don’t want to leave your job. Luckily for you, you don’t have to! If you do however stop working when you reach State Pension age, you will no longer have to pay National Insurance. Moreover, the law protects you against discrimination if you have surpassed State Pension age, so rest assured you can find a new job or stay in your current job without worry. Despite this, there are certain circumstances where employers may decide to set a compulsory retirement age, such as those in the construction industry. The VerdictThere are countless factors you need to consider when it comes to finding the best retirement plan for you, including taking your earnings into consideration to pick a suitable plan. Ultimately, there is no ‘best option´ for everyone, which is why when you answer these questions yourself, you will gain a better understanding of what retirement plan you would like to undertake. Good luck!

Having a secure future for retirement requires exploring a variety of options. You also need to look at the different aspects of your life to ensure financial security when you retire. When it comes to retirement, perhaps, one of the most challenging to prepare is inflation. Often, retired individuals are on a fixed income, and the adjustments on the cost of living do not keep up with the actual costs. You may try to eliminate some monthly bills, but you have very little control over your electric bill. If you’re on a fixed income, it can be very devastating when your electric bill becomes doubled. Going solar in retirement is actually the best way to save money and control your power cost. Installing solar energy system on your home allows you to minimize your energy spending. Whether you are close to retirement or already there, it is important to find ways to cut back on your spending, and turning to solar is one of the best solutions. How to Save Money by Going Solar in Retirement? Here are some ways that solar panel can help cut back on energy spending.

Solar Reduces or even Eliminates your Electricity Bills. Solar energy systems can actually generate up to one-hundred percent of your electricity requirements. This means that you are able to eliminate your electricity bill and free up more cash each month to invest or spend on some other important things you need to purchase. Solar Improves the Value of your Property. If you are thinking of putting your house in the market in the future, then installing a solar energy system is a great investment. It has been found that many homebuyers are willing to pay more for houses with solar energy systems installed. Solar allows you to hedge against future increases in utility price. The utility electricity rates continue to go up each year, and just in 2015, they went up by anywhere from three percent to 9.6 percent. When you install solar energy system, you can generate your own electricity, you will be able to protect yourself against any unpredictable rate increases for your solar energy system’s lifetime. It usually lasts around twenty to thirty years. Going solar when you retire or even before your retirement is probably one of the best retirement plans you can consider to secure a financially-stable future. It allows you to improve the quality of your life and attain financial freedom and stability. Instead of worrying about your electric bills, you can have your own electricity source and save money for some other important spending. If you want to ensure a smooth transition into retirement, you need to consider all your available options. It also requires practicality and choosing the right strategy that works. Don’t overlook the benefits of installing solar energy systems on your home. This can actually be one of the most remarkable investment opportunities you can make when you retire. It is inevitable for small businesses to require outside financing to grow. There are diverse funding options available such that it has become easy for individuals to get small business loans. Nevertheless, such variety of lending options can present a challenge in that it is hard for business owners to be sure of the choices they are making in terms of the best loan provider. The following 5 tips will help you increase your chances of finding the best small loan provider that aligns with your needs. 1. Establish your needsKnowing what you need will determine the type of loan provider you choose. Different loan providers have varying terms and conditions. Being aware of what you need will help you establish whether taking a loan from a funding company is worth the struggle. Additionally, establishing your needs should also guide you to focus on a loan provider that offers loans based on your expected terms and conditions. 2. Have all the information about your businessPrior to making any loan application, ensure that all important information about your business is ready. Usually financial documents are key documents that any loan provider would want to see. Other important and necessary information include the ownership of the business, employer identification number, taxpayer ID, as well as income information. Having this information increases your chances of getting the loan approved quickly. 3. Screen various online lendersNowadays, majority of online lending companies are engaging in predatory practices. If you are not careful, the chances of being conned are high. It is advisable to work with a loan provider that is comfortable offering loan terms upfront. Also, look for one who has security disclosures on their web pages as well as a physical address. 4. Carry out a true-cost analysisDifferent loan providers have varying repayment terms, and APRs (the term that describes how much money you are subject to paying including the fees and interest rates). These two factors form the basis for comparing loans from different providers. If you are looking for a merchant cash advance, you should be ready to pay higher APRs, and a weekly or daily repayment terms. Online term loans are high in terms of APRs when compared to financing from traditional banks. They however; attract low interest rates than merchant cash advances. 5. Know the focus of lendersLenders often use different factors to measure a person's eligibility for a small business loan. For example, debt service coverage ratio (DSCR) is an element of consideration in the event you are looking for loans that are competitive in price, and are of better terms, and lower rates. Other lenders look for a strong personal credit score, and yet others focus on the property or inventory of your business.

While it is tempting to apply for a loan from any online lender available, taking the time to understand the terms and conditions can save you much inconvenience. As such, you need to take the time to research about the lender’s reputation, and read through the fine print before applying for your loan.

Advantages to Pension Fund Investing

A retirement pension fund is the typical method of retirement savings and investing. For this reason, it’s often viewed as the safer investment bet when you’re planning for your retirement. Pensions rarely lose money that is invested into them, although they may not grow dramatically, either. There are also extensive tax benefits involved when putting your retirement investing into a pension fund. If you choose to use a company pension program, the money you contribute towards your retirement will be pre-tax.

While this reduces your total taxable income in the present, you will be forced to pay taxes on your retirement savings later in life when you go to withdraw. On the other hand, if you invest in a private pension fund, the likelihood that you’ll invest from your net-income (or post-tax income) is high, and your withdrawals during retirement will be completely tax free. Regardless of which fund you choose, having tax benefits on the front or back end of your investing is a definitive benefit of pension fund investing.

Another advantage to pension funds is that, in many cases, an employer will contribute an equal amount up to a certain percentage of your pay towards your pension fund. These match programs can drastically increase your overall retirement savings, and if you contribute wisely at the beginning of your career, you’ll be able to earn interest on a greater amount of funds invested for a longer period. These extended earnings have the potential to set you up nicely in your retirement. Disadvantages to Pension Fund Investing

While pension funds do offer a secure way to invest and save for retirement, they can also be disadvantageous. The most notable disadvantage of pension funds is the lack of flexibility in when you can access your money. In most cases, you won’t be permitted to withdraw funds from your pension until you’re 55, and even then you’re subject to taxation. For those who are interested in possibly retiring early or taking an untraditional retirement in which they start a second career, go back to university, or choose to live internationally, these pension fund withdrawal limitations may be restricting.

Additionally, the performance of pension funds depends entirely on the investment of your assets. If you invest poorly, or in too conservative a way, your funds may not grow much, if at all. This means that your pension fund is essentially a glorified savings account with employer contribution and better than average interest. Still, for many, this isn’t enough for them to live the way they want to during their retirement. Advantages to Property Investing

When you choose to invest your retirement funds in property rather than a traditional pension fund, you have significantly more flexibility when managing your investments. For example, you can monitor the real estate market to select the perfect property investment, and from there you can choose to either live there full time, use the property as a vacation space, or make even more money on your investment by setting it up as a rental property. If you ever want to sell your property, it is a physical asset and you have the capability to do so. Whether you’ve decided you’d like to use your funds earlier than planned, or you are ready to invest them in another market, selling property is much easier than cashing out your pension fund early.

Additionally, the property market has more flexibility with the levels it can fluctuate. You can purchase a property in a buyer’s market and sell for significantly more in a seller’s market, often making much more on your investment than you would have made had you put the same funds in a traditional pension fund. Disadvantages to Property Investing

Admittedly, property investing is much less stable than pension funds. Property markets tend to fluctuate with some regularity and little to no warning. There are also more maintenance expenses and up front taxes involved with a property investment. These upfront expenses can often be a deterrent to those looking for investment opportunities, and few view an expensive property as a viable means to save for retirement as a result. Despite the inherent volatility of property investing, it can often be an excellent vehicle for those looking to invest or to access the return on their investments sooner than a pension fund would allow.

Should You Consider Overseas Property?

The answer to that is a glowing “yes, absolutely”. If you are going to go with property investing in spite of the inherent risk you should consider doing so abroad. Some countries like Romania can offer staggering returns of 7, 8 or even 9% annually. You could potentially diversify your overseas property investments over 4-5 developing countries (in which homes are very cheap in, with high annual rental yield) and minimize the risk, and be much better off upon pension.

You don’t have to worry about dealing with the nitty gritty. There are professionals in the field that specialize in dealing with foreigners. Lawyers, property agents, and international money transfer companies deal with tens of thousands of clients just like yourself.

What is the Bottom Line?

To each his or her own. Both options are valid, it just depends on how risk averse you are, and of course, your financial status. No matter whether you choose to invest in property or a pension fund, be sure to consult a qualified adviser who can help you make the wisest choice based on every factor affecting your decision.

Retired Brains does not offer direct financial investment advice, nor do we affiliate ourselves with any particular financial advisers or firms in the United States or worldwide. Rather, the sole purpose of this article is to present educational, helpful information that can help you decide what kind of investing strategy is right for you in your retirement. If you are interested in learning more about property or pension fund investing, we recommend seeking out a reputable adviser or firm in your area for assistance.

No matter your reasons for wanting to find temporary and part time jobs, it is important to know that you have more options than ever before when it comes to landing the perfect retirement job. Why Retired Workers are in DemandMore and more are opting to turn to workers with a more mature, loyal outlook on employment. Some of the reasons employers are gravitating toward retired workers to fill temporary and part time job positions include:

This shift in attitude is plainly seen in the steady increase of retired workers in the job force. According to the United States Bureau of Labor Statistics (USBLS), retired workers currently comprise over 8% of the workforce. This number is expected to increase to 11% by 2022. Additionally, recent data from the USBLS shows that as life expectancy continues to increase, so does the amount of older retired workers in the workforce. Specifically, since 1985, the number of retired workers over the age of 75 has more than doubled from 3.6% to 8% currently. Why Temporary and Part Time Retirement Jobs?Although some retirees decide to continue working a full time career into their retirement years, we feel this is a decision best left to your individual needs and situation. There is something to be said for allowing yourself to enjoy your retirement as you see fit. The responsibility and, many times, stress accompanying full time career occupations can become more difficult to successfully manage as we age. However, the job can accentuate and compliment your leisure time, and not take away from them in any regard. Many temporary and part time retirement jobs allow you the freedom to make your own schedule, as well as the other benefits of employment we have discussed already. What is more, many temporary and part time retirement jobs allow you to help other people in various capacities, which is always a wonderfully effective way to be involved and feel great doing it! You might be asking yourself how you can go about finding jobs that allow you to choose your own schedule, and provide you the opportunity to embark on employment that compliments your retirement living? Well, let’s discuss that right now. Using Shiftgig to Find Part Time or Temporary Retired Jobs Shiftgig is in 12 cities located across the United States currently Shiftgig is in 12 cities located across the United States currently Retired Brains has found a company that takes a uniquely effective approach to helping retirees find part time or temporary retirement jobs. Since 2012, Shiftgig has helped match businesses in the hospitality and service industries (so people-based businesses) with people seeking flexible, fun and fulfilling part time or temporary jobs. Shiftgig helps make finding part time or temporary retired jobs easy. First, you fill out an application on their website. From there, a member of the Shiftgig team will reach out to you via email to set up an in person interview. If hired, you'll use their mobile app to browse available work and other specifics relating to the job you choose.  Shiftgig is currently located in 12 cities around the country: Atlanta, Chicago, Dallas, Houston, New York, Memphis, Miami, Milwaukee, Nashville, New Orleans, Phoenix and Tampa. However, their popularity means you should be on the lookout for them to put roots in your city soon. No matter where you look for and find part time or temporary retired jobs in your area, we hope that you find it. What is more, we hope it increases your quality of life by adding value to your retired years, while having some fun in the process! *Retired Brains is not an employment service, and does not offer job counseling or personalized employment advice. We simply strive to help boomers, seniors and retirees of all ages find resources that help add value to their lives. Retired Brains is not affiliated with Shiftgig, but find their platform to be unique and potentially helpful when looking for part time or temporary retirement job opportunities. Therefore, we always recommend doing your homework to make sure the job resources you choose are a good fit for your wants, needs, situation and of course, technological abilities.

With increases over the past several years in regulations protecting borrowers, reverse mortgages are being considered viable options for helping some people fill gaps in their retirement income. However, the question of, "Are reverse mortgages a good idea?", is solely dependent upon several factors. These factors relate directly to the individual or couple looking to enter into a reverse mortgage agreement.

If you are wondering are reverse mortgages a good idea, we welcome you to read this reverse mortgage information article and learn whether or not you may be a good candidate for one*. Reliable, unbiased information about reverse mortgages can be difficult to come by. If you are looking for trustworthy information about reverse mortgages, it is important to consult organizations that have no direct financial stake in whether or not you enter into a reverse mortgage agreement. Information About Reverse Mortgages

According to the Federal Housing Administration, approximately 30,000 people entered into a reverse mortgage in 2016. This number is down significantly from the peak of the reverse mortgage boom in 2009, which saw over 115,000 of these types of home loans processed. During the boom of 2009, the reverse mortgage market was deregulated, which ended up causing serious issues for many borrowers.

However, increased lender regulation has afforded better protection for borrowers. Even with more protection, you still should ask yourself “Are reverse mortgages a good idea for me?” based on your specific situation--instead of relying on existing industry safeguards, which might not apply to your situation anyway when push comes to shove. The following information about reverse mortgages can help you decide whether or not you are an ideal candidate for a reverse mortgage… Who is the Ideal Candidate for a Reverse Mortgage?

More Reverse Mortgage Information

Before applying for a federally insured reverse mortgage covered by the US. Department of Housing and Urban Development (HUD), you are required to meet with a counselor from an independent, government approved housing counseling agency. Your counselor will go over the loan’s cost, as well as any financial implications you should be aware of. This consultation can be incredibly helpful in deciding are reverse mortgages a good idea for your situation. You can visit HUD for a list of counselors, or call the agency at 1-800-569-4287 to learn more. Please note that counseling agencies usually charge for their services. However, their fees can be paid from the loan proceeds, and you cannot legally be turned away if you can’t afford the consultation fee.

Reverse Mortgage Alert: Find Reverse Mortgage Lenders

If you feel as though you would be an ideal candidate for a reverse mortgage, the next step is starting to shop around for the right lender. Retired Brains has found an excellent informational website called Reverse Mortgage Alert you can visit to assist with the shopping process. The Reverse Mortgage Alert website has some very useful information for first time borrowers that can help reduce the confusion and stress often associated with the reverse mortgage process. This includes compiling lender information, providing a reverse mortgage calculator, offering information on the pros and cons of reverse mortgages, and a very informative fact sheet to help empower you in your decision making process. Please visit Reverse Mortgage Alert to learn more.

*Retired Brains is not a reverse mortgage lender, and we do not provide direct or indirect advice on whether or not you should enter into a reverse mortgage agreement. Our sole purpose is to provide you with information that can help you decide if you would like to find out more about whether or not a reverse mortgage is right for you. Therefore, we cannot be held legally or financially liable for your personal decisions. If you have any questions about a current or potential reverse mortgage agreement, we urge you to contact a professional adviser who can help you find the answers you seek.

|

Archives

July 2024

Categories

All

|

Employment Resources |

Creating Income |

Most Read Pages |

Resources/Info |

|

Copyright 2022 by Retired Brains

|

Disclaimer: We do our best to ensure the information on RetiredBrains.com is accurate and updated at all times; however, we are unable to guarantee the accuracy of all information. We make every attempt to keep the content up to date and factual. For the most current and complete product/service details please verify with the merchant, product, issuer, or service directly via their website or during the buying or application process. Please be aware that RetiredBrains may have a financial relationship with some of the sites included on our Website. RetiredBrains.com may receive compensation if users choose to click on the links located on certain pages of this website and sales and/or leads are generated. If legal advice or other expert assistance is required, the services of competent professional persons should be sought.

RSS Feed

RSS Feed