|

Online dating is no longer a new aspect, and it seems to be the preferred way of meeting a partner in life. Therefore, there is an increase in the number of subscribers. These include both the young generation and the seniors. For the seniors and to be specific over 60 dating online might not be an easy thing for them as may seem for the younger generation. There are senior sites for over 60, but still, it is hard for this group to achieve a successful experience when they are trying online dating. Here are some dating tips for over 60 dating. There is Always Someone for EveryoneDon’t shy away from proposing to someone. There is always someone for you, and they might be the one you are just looking at. Therefore, when you log on to over 60 dating sites, go on and propose to that special someone who attracts you. Some over 60 dating men or women will feel like it is a mistake to propose to someone they meet on the dating site. You should ask yourself why that person posted their profile there, and don’t shy away. They are also there because they are looking for someone to love them. That is the right time for you to start the conversation so go on and start. Age is Just a NumberFor many single men in the age group of over sixty, they will feel like they are not fit to be dating. There are millions of singles just like you who are using online dating to seek for partnership. Everyone needs love and wants to be loved too. Therefore, don’t lock your opportunities because you think you are old. The good thing is that we have senior dating sites over 60 and therefore age should not tie you from dating when you feel you should. Remember the age is just a number. Actually, you might also try dating sites where you meet other ages too. You Can Have Many Activity Partners Over 60 Dating is not only about the companion. You can find several activity partners, travel mates as long as you want to. Therefore, go on and propose to multiple partners and play your cards well. Dating is fun, and you should not limit your fun. There are several senior dating sites for over 60 and even dating sites for seniors over 70, 80, this allows you to explore and feel the difference. After all, you are about to retire, and you will be less busy. Have fun while you can and enjoy life. Date as many as you want. Watch Out for Those with Hidden AgendaSome people will pose as people ready to date you, yet they are after your money. Not all dating profiles on the applications have genuine people. Choose the sites you use wisely and don’t go into it very fast. Take your time and think well of the person. If you identify some traits that suggest not too good, just leave the person.

Don’t share sensitive information anywhere public, you can disclose those to the person who qualifies to be your dating mate later. Useful Reference Source:

0 Comments

Retirement may be the ideal period of your life to relax and smell the flowers, but it should not be an excuse to slow down to a complete standstill. In fact, research has indicated that those who keep their mind cogs whirring and their legs marching forward tend to live longer with more fulfilling years to show for it, which is why you should stay motivated and really squeeze retirement for everything it’s worth. And here is how to do that. 1. Stay Physically ActiveOne of the biggest temptations in the retirement world, is to sit around all day in your underwear and watch TV. While this may seem like a fun idea for a while, your body won’t thank you in the long run, as your blood flow will struggle to reach all ends of your system and your muscles will slowly begin to fall asleep. Your goal should be roughly two and a half hours of gentle exercise a week, which is not a lot to ask. Just by keeping it slow and trying new stuff (like cycling, tennis, or even walking a dog), your will find your energy levels increasing and your endorphins flowing, making you healthier, more alert, and much happier in these golden years of your life. However, please speak to your doctor before you try anything you’re unsure of, and keep your emergency contact and medical details on your person at all times. Remember, medical alert bracelets and necklaces can save your life! 2. Stay Socially ActiveHumans are social creatures by nature, which is why retreating into a shell of retirement reclusiveness could negatively impact your mood, and even stagnante your brain. Even if you’ve never been one for casual conversation, you can still reap the benefits of communal interaction by joining local clubs, or volunteering your energy to a worthy cause. Of course, you should not forget those who you are already close to, and devoting your newly freed up time to your loved ones could be the most rewarding part of this new chapter in your life. Pick up the phone and fill your calendar up with these exciting engagements as quickly as possible! 3. Start a HobbyDuring those tiresome working years, it always felt like you had a million things you wanted to do, but never had the time to do it, right? Well, now you have the time to do it! Get a pen and paper, and start listing what those projects were. Some examples may include: learning an instrument or a new langauge, cleaning out your garage, gardening, assembling rare collectibles, photography, scrapbooks, pottery, cooking, playing chess, reading a novel a day, writing your own novel… this could go on forever! Simply put, retirement is not an excuse to let your brain fall asleep. Aim the momentum of your working mode at the stars, and stuff your mind with skills far beyond your comfort zone. 4. Make More MoneyWait, didn’t you just leave your job? Why would you want another one? Glad you asked. Some of the answers include: to keep your keys in the ignition, to give your life more purpose, and to raise your reserve funds. Because who doesn’t want more money? Anyone? Retirement could be the perfect time to experiment in a field completely unrelated to your previous job. For the more adventurous, why not attend a stock exchange course and give that a try? Or perhaps use your previous experience to educate eager minds? Or start a new business revolving around an idea you had many years ago? If this all sounds a little daunting, then keep it simple, by volunteering, watching people’s empty houses, or becoming a tour guide. Just be careful not to invest too much of your capital into any given project, and when in doubt, always get professional advice! 5. Plan a HolidayWhy not escape real life for a while and take a trip somewhere you’ve never been? As everyone knows, even planning a holiday can be almost exciting as the holiday itself, as you eagerly tick the days off the calendar while the big event approaches. And then explore the world as far as possible, taking hundreds of photos along the way so you can boast to your friends.

Even if this is not a feasible option or if you want to kill time in between your big trips, simply do the next best thing and probe your local area. Walk a different direction or investigate a nearby park with full intention to get a bit lost (just don’t forget the map!). Become the neighborhood expert of your suburb, until the veins on the back of your hand start to resemble the roads that surround you. In summary? Get moving! What to ExpectThe path to retirement is a complex and arduous one, a journey that requires careful planning, diligence, and financial investments. However, once a retiree reaches the brass ring, they may find themselves unfulfilled – perhaps they enjoy tasks, busy work, organization, or routine, aspects that drifted away during their tenure at a full-time job. In the same vein, some are marching towards their seniority with the wind on their backs, scouting for work to help them prepare financially. Whatever the case, some adjust to their golden years by seeking comfortable part time work suited for older individuals. Thanks to technology, the internet, and living assistance, options are abundant and most boomers find themselves a position that is both rewarding and practical. It’s not an uncommon practice, either. According to the Bureau of Labor Statistics, 40 percent of individuals at age 55 or older were seeking employment in 2014 alone. This value is expected to increase as opportunities expand. What does that mean for you as a retiree – or someone on the way to retire? You’ve got flexible routes to earn consistent income. But the question is, how do you find the right job for you? There are various resources to help you locate employment that fits your needs, along with tips for elderly individuals to help them get back in the swing of modern jobs. For instance, we have a large cache of tools you can use to assist you in finding work. You can also look to your caregiver (if applicable) to help you when seeking employment. This can range from anything – from helping you freshen up your resume and supplying it to the relevant websites – to transportation and physical assistance where necessary. Preparing for EmploymentThough a retiree may not have worked for several years, the formula for gaining employment is still very much the same. As someone looking to rejoin the workforce in various industries, you should make proper accommodations and preparations, just like anyone would when seeking jobs. Some of those preparations should include highlighting various skills you’ve gained over the course of your life’s work. Specify them on a resume, integrate them into your cover letter(s), and mix them into the interview process. If relevant, you can ask your caregiver to help you practice. This is because modern workforces are adaptable and welcoming to older generation workers. According to AARP and Towers Watson research, business owners found that 50+ workers had the skills, motivation, and experience they needed for new work. This doesn’t mean looking for new jobs will be a breeze – all companies and positions have their own requirements, as expected. But in the same vein, you aren’t approaching a job market which is only friendly to the young and newly trained. Questions to AskIf the idea of finding work for retirement still interests you, it’s a good idea to “survey” yourself about the various expectations you have for new jobs. We’ll highlight those questions in just a moment. While we’ve pointed out the opportunities available, not all of them are a match for individuals. As a retiree (or soon to be retired) you have to consider what matches to make sure your path to new work goes well.

These questions will (hopefully) give you an accurate assessment of your current capabilities and goals. We assume that as a retiree you’re looking for fulfilling work, but not something that interferes with the time spent in your golden years. Additionally, we understand you may soon plan for retirement, and are looking for avenues to create financial stability, while still minding what you can or cannot do. Based on these questions, you might want a senior level position with solid benefits and good pay. Or, you’d like a casual part time job that pays around the minimum wage mark – but doesn’t have the same demands. However, even as an experienced individual, the bigger the fish, the harder it is to fry. AKA, higher level positions are challenging to come by without specific experience. For instance, a Senior Customer Management Specialist might require experience in the relevant industries going on for 5+ years, along with educational requirements like an associate or bachelor’s degree. So, while it’s admirable to seek out high-level positions, understand you might face frequent pushback, whereas other forms of work will accommodate you easier. The Caregiver’s RoleYou and your caregiver are a team, and as such, you can work together to make sure the transition into retirement or retirement work is as smooth as possible.

Even better, family and friends can work as a paid, full time caregiver assistants through the Consumer Directed Personal Assistance Program. Because the elderly is often impoverished and rely on financial assistance for so many things, having someone they know (and cares for them) is a relieving prospect. Additionally, compensation for caregivers is often handled on friendlier, positive terms. There are third party resources that pay them, or, you as the elderly can write up freehand contracts to have them compensated. As a retiree or someone soon-to-be retired, you’re not alone. Hopefully, our resources give you an idea of what you can expect in a modern-day workplace, along with how your caregiver can help (and benefit) you along this journey. Christmas is fast approaching. Given the tough economic times, most households would appreciate making some extra money to take care the numerous expenses that come with the festivities. With the rising prices of commodities, the average cost of celebrating Christmas is going up every year. Sadly a majority of people splurge hordes of cash and end up starting the new year in debt. Decluttering makes an excellent way to make a few more pennies. It also creates space for new presents and takes advantage of cheap Christmas bargains. Keep in mind that this is the time you will host friends and the family members, hence the need to create a neat and tidy house for them to stay. What to SellOld Toys Your kids/ grandkids may have all grown up now but I’m sure you would be surprised at how many toys have been left lying around in the house or in the loft. Many toys especially older wooden toys or any new ones in a good condition are in demand especially this time of year Old Electronics Selling old electronics such as mobile phones, cameras, TV’s, games consoles, video players etc can make you much more than you might think, even in a broken condition. Many people buy these items to either recycle them, repair them or use them for parts, especially older rarer items that are difficult to get hold of can be very sought after to the right person. Videos, CDs and DVDs Now that video, DVD and CD players are no longer a necessity with everything available straight from your TV or phone it’s a good opportunity to clear out any unwanted items of these. Although home videos of family and your favourite greatest hits albums will always be treasured I’m sure there’s plenty you can say goodbye to. Old Furniture Old furniture can be a huge money maker as more people are getting into the re-upholstery and upcycling business and always on the lookout for old unwanted pieces they can restore. So although it may be tired and worn this doesn’t make it worthless. Old Clothes Check your wardrobe for old clothes. Some people may have a hard time deciding what to sell; if you have not used a special dress for a year or more, the likelihood is that you won't wear it in the future. Be sure to involve the whole family in de-cluttering the house to make as much money from the sale as is possible. Where to SellCraigslist It makes a convenient way of selling used items. While users can sell anything on Craigslist, it is designed for large items like furniture. If you are not sure about the right price to charge the item, use the Search icon to view the cost of similar items. Insist on taking cash and the presence of a few friends at your home if the buyer wants to see an item before purchasing it. Multiple pictures, a detailed description of the item and providing a specific location helps attract serious buyers. Online Yard Sale Setting up a physical garage or yard sale is the most popular way of selling old items. However, it is pretty time-consuming, labour-intensive and you may not make as much money if you are living in a small neighbourhood. The recent craze involves selling items through online yard sales. It mimics the traditional yard sale only that it is done online. To find an existing garage sale, search on Facebook using your neighbourhood's name. If you don't see one, create your online yard sale. There's no restriction as to the kind of items you can sell through this platform; kid’s clothing, furniture and toys are some of the most popular items. An online yard sale is safe as the seller can view images of the person buying the item. eBay It makes the best platform for selling used items when decluttering. eBay is ideal for people selling small items like coffee mugs and books. To save on time, look for similar items that have been sold recently; you may use eBay's Advanced Search setting. You should also take some good photos of each piece you intend to sell and create engaging listings to attract buyers. Consignment Stores or Sales The technique may not be as popular in the recent times, but it makes a good bargain for your items when compared to a yard sale. You only need to stop by the store with your clothes or other things and wait as the attendants look over them. When you have sold $ 10 or more worth of clothes, they contact you to collect the cash. Most areas have kid's consignment sales. Book Buying Back Sites If you are selling unwanted books, consider book buy back sites like Amazon, Sell Back Your Book and Cash 4 Books. Books and textbooks written by famous authors sell fast and at a reasonable price. If you just graduated, you may want to sell the books now before new editions are released. ConclusionMaking some extra cash by taking part in a de-clutter exercise before Christmas creates space for new items and also leaves your garage and house neat. However, the activity makes a temporary way of boosting your budget as you may run out of things to sell over time.

Here are five tips for a successful job detox you can begin today. 1. Accept more time for yourselfWhile you were working, you would have spent most of your time focused on others and the organization your worked for. But now you have the time to think about what you want. Accept this as a gift. Kick back, prepare a cup of joe (or tea), and just…be. This precious time will help you figure out what experiences you may have missed while you were employed. Then you can take the necessary steps to begin capturing (or, re-capturing) some of those experiences. This is also a good time to create a “Lessons Learned” list where you write down all you learned about yourself and others during your years of employment. This can prove helpful in your next phase of life, whatever that may be. 2. Create a gratitude listAnd speaking of lists, during the first phase of retirement, try also creating a gratitude list. Even though this is one of the easiest rituals you can do, it can give life to a large number of benefits in the long run. A gratitude list can set the tone for the coming weeks by elevating your feelings and sharpening your perspective. Ironically, it is during times of severe irritation that gratitude lists can have the most beneficial impact. Even fake it, if necessary. Begin writing what you are thankful for (even for waking up alive this morning) and, over time, the “intention/reality” connection will form. 3. MeditateYou have been dealing with various stressors for decades and now it is the perfect time for you to decompress. Daily meditation can help. Meditation has been shown to reduce stress and anxiety, help you get a better night’s sleep, and even relieve pain (mind over matter? Yup!). Putting just 10 minutes aside each day to clear your mind and open yourself to the universe will bring renewal to your soul and body. Start small. Find a quiet place and just focus on your breathing and how your body moves with each breath. Go easy on yourself when your mind wanders. That’s normal. Gently call yourself back to your breath and start again. It gets easier with time. 4. Pay attention to your healthBusy schedules and work demands have a way of nudging out healthy eating and exercise. For example, you may have resorted to junk food for long periods of time, and found yourself scarfing down lunches in order to get back to work. Now you have time to explore best ways to optimize your health and well-being. Stretch when you wake up, get outside, drink lots of water. Long walks with loved ones is a great first step. Visit your doctor, have a check-up, make a plan, and start some better practices. Few investments return better than those related to your health. 5. Help others with your expertise and experienceThroughout your years of full-time work, you have accumulated tons of expertise and experience. Now it is the perfect time for you to share the career assets you have accumulated with others in need. You can easily do this through volunteering for a cause you believe in, taking on a big project you know needs doing, or even starting a side business based on the expertise and experience you’ve accumulated. The point is you now have the awesome opportunity to re-design your life and career based on your own values and your passions. The successful job detox provides a clearing for new possibilities to emerge. Go for it! Peter Spellman helps people discover their next calling through practical online courses and coaching. Find him at Nextcalling.org. It is no secret that divorce is on the rise for people over the age of 50. As America’s population continues to age the upward divorce trend shows no indications of slowing down. Divorcing after many years presents many issues that younger couples do not have to face. Spending decades together building a life together can be complicated to untangle. RetirementWashington is a community property state, and the money that is earned during the course of the relationship is characterized as part of the community. This means that the money earned is considered the property of both spouses. Furthermore, this extends to pension accounts and retirement accounts. The accounts will be split between both spouses in the event of a divorce. Typically the court will try to divide the assets evenly; however, this does not mean that both sides will receive the exact same share. The court looks at the position of both parties and does what is just, given the entire circumstance. Dividing up the savings that has been accumulated for years prevents many older couples from pulling the plug on their marriage. Living ArrangementsOne of the most important assets that a couple shares together is their home. After many years of marriage the house can have thousands of dollars in equity built up, or perhaps it is entirely paid off. This then becomes a very important asset to both spouses.

As we stated above in a community property state such as Washington, the court looks divide property evenly. In a situation where one spouse chooses to keep the home this can amount to hundreds of thousands of dollars. If this is so, then other assets such as retirement, pensions, spousal support, and other household valuables may have to be reallocated in order for everything to balance out. There are many other considerations that go into a divorce after many years such as alimony payments, and even perhaps family pets. The team at Humphrey & Associates understands these complexities and has achieved much success as a Bellevue divorce attorney. We specialize in splitting property in a way that is just and equitable takes time and consideration to do properly. Retirement planning is all about keeping your eyes open for all the opportunities that are available for you. One of the opportunities that are rarely taken into account is offered by the 1031 exchange. This is basically a special type of real estate transaction through which capital gains are completely avoided. Even if you do not reap on all the benefits associated with the practice, heirs can. Real estate investors are often looking for such properties so maybe you might want to do the same. Explaining 1031 Exchange PropertiesTo put it as simple as possible, 1031 exchanges happen when you exchange a real estate property for another with the purpose of making an investment. If a specific transaction is labeled as 1031, there is no tax that has to be paid or the tax will be limited. Absolutely no limits exist in regards to frequency or number of times exchanges happen. Profits can appear with every single property swap and taxes are avoided until you are selling the property for money. This is when you hopefully have a much higher value for the property and there is long term capital gain that appeared. Keep SwappingMost people are aware of the fact they can sell investment land and then buy office rental property. Capital gains are automatically gained in most situations. In order to transform the experience into 1031 exchange properties investments, investors need to:

According to the IRS, the 1031 exchange is not going to be possible when exchanging:

Holdings GrowingWhen the real estate sale and the purchase are qualified for 1031 exchange (commonly referred to as Starker or like-kind exchange) and you are meeting time frame requirements, the government’s money end up being used to grow holdings. Real estate investment property value increases automatically as you repeatedly trade in order to increase rental income or value. Capital gain taxes are deferred with every single swap. Money that should have been paid in taxes end up in your pocket so you have higher equity for the following transactions. This is really interesting as you prepare for long term value increases for all the real estate investments and it is the government that becomes a partner to your real estate portfolio growth. At one point in time the final sale is going to happen without the 1031 exchange. This is when you need to pay taxes for the accumulated capital gains. In the event the investor dies, last property cost basis will be adjusted based on the current value. Heirs are not held liable for the accumulated capital gains taxes. This is why many consider the 1031 exchanges as a part of the long term retirement investment plan that they set up, with a premise to leave for heirs. Retired Brains does not offer direct financial investment advice, nor do we affiliate ourselves with any particular financial advisers or firms in the United States or worldwide. Rather, the sole purpose of this article is to present educational, helpful information that can help you decide what kind of investing strategy is right for you in your retirement. If you are interested in learning more about property or pension fund investing, we recommend seeking out a reputable adviser or firm in your area for assistance. Life expectancies are increasing so retirement years extend. This makes many retired seniors think about opening a business. That is definitely not something unheard of since around 15% of those that are 55 or older are now expected to start a new business in the US. You can obtain pretty good annuity rates from top rated annuity companies and you get access to savings so why not open a business? If you do want to do this though, you want to prepare yourself for the potential pitfalls, with the following being the really common ones. Misaligning Goals With Lifestyle HabitsThe retirement entrepreneur often decides to open the business because of being bored. After some time the individual ends up realizing that they would rather do something else. By the time you figure out the fact you want to do something else it may be a little too late as much time, energy and capital were already invested in the business. Remember the fact that when you run a business the entire process will be challenging. When you really want to spend more time with the family, it is a huge disservice to launch a new business since you would most likely end up working much harder than expected. Evaluate all the goals that you have at the moment in relation with your life and the business you may want to open. This will help you to see if they align in any possible way. When so, your approach becomes much more balanced and life would be better. Too Much RiskAfter a proper assessment was done in regards to goals and your conclusion was that you want to start a new business, you want to actively understand risks. Businesses do mean that startup capital is necessary and financial pressure tends to be high. A huge mistake is to fund businesses with retirement savings since if the business will fail, you end up without money. Rebuilding savings after you are retired is really difficult. Not Enough Physical StaminaRunning and even starting the business will be a feat for the entrepreneur. When health issues appear, you want to be completely honest with yourself and decide if it is a good idea to open the business. Think about the energy and time that can be devoted to the entire operation. Failure risk will further impact health so this needs to be absolutely taken into account. A highly successful business will be demanding, especially when looking at startup phase. Too Much OptimismTime will not be an ally when you are older as an entrepreneur. There are not many years that will be available to fix possible mistakes. Mistakes are going to happen so you need to be careful that you do not make really serious ones. If you are way too optimistic you open the doors to failure since you do not have all the time that the younger entrepreneur has. What is important is to always understand and accept that success will not be guaranteed. This is the type of approach that the retirement entrepreneur needs to have.

It has been said the easiest instrument to play is the ukulele. It's not only easy, but it's one of those instruments that has a sound that can go from beautiful and classic, to fun and raucous. As will be seen by the seven easy ukulele songs included here for beginners to learn.

You can find more help at ukulele-lessons.com and anywhere on the internet look up "helpful ukulele tabs", but I prefer looking up the actual chords for easy ukulele songs, and then add 2 or 3 chords to your search. There are multiple benefits of learning an instrument as you age. The Brain and Social InteractionYou develop your brain by using several parts that keep your mind sharp. As stated on the link above, playing an instrument does for your brain what circuit training does for your body. It incorporates various sections of the brain that need to function while playing and learning the instrument. These functions you need to keep the brain healthy as you age. You socialize with others who play instruments. What better way to find friends with similar interests? I have made more great friendships with fellow musicians than any other hobby. Get out and start "jamming" with others! Personality and Self-EsteemEach instrument brings out a part of your personality. Just because the ukulele is the easiest to begin playing, it doesn't mean you have to only play the ukulele. When I was young I learned the guitar. It made transitioning to the ukulele very easy, but from that instrument I went on to play piano, percussion and drums. It's like learning a new language. Once you learn one, you find the rest are easier to pick up on. As we age, its nice to know there is something that will make us feel both useful and capable. The ukulele, like any instrument, will give you a sense of self-esteem, especially if you are tackling it at a time everyone is telling you to slow down and just stop. Well this is the exact time you should start. Physical and SensesWhenever you play an instrument you are using fine motor skills. The ukulele stretches the fingers and bends the arms, incorporates the shoulders and muscles you don't usually use. Don't forget to use good posture, as well, whenever you play an instrument. Your body will thank you in the long run. There is no doubt listening to music builds the sense of hearing and brings all those parts of the senses you need to truly appreciate sound. Emotional and Self-WorthSometimes, when you are alone there is something comforting about playing an instrument. Its what I call, "soul charge." An instrument will undoubtedly charge you when you're feeling down. It's one of the best cures for depression.

To tackle something after age 60 always makes us feel we're still learning and moving forward. That's always a good feeling. In fact, tackling any new task at any age is well worth the challenge. As an old Danish proverb states, "Age may wrinkle the face, but lack of enthusiasm wrinkles the soul." So please, try these seven songs and enjoy learning something new! Here's to taking up an enthusiastic new hobby! It can be easy to forget about the importance of saving up for retirement when it’s still decades away. This is especially true now that the retirement landscape is changing; the days of retiring at age 65 are becoming a thing of the past. Now that our life expectancies are increasing, people are able to work well into their seventies, and working from home is becoming more commonplace, we’re starting to rethink the best ways to save for retirement. Part of this planning involves understanding how certain life decisions can affect your retirement savings. Here are a few personal choices that most people make during their lifetimes, and how they can influence your retirement savings decisions. Building a FamilyWithout major reform, Social Security benefits will need to be cut by 23% in 2033. This means that you need to plan ahead to make sure you have enough money to retire comfortably without relying on Social Security checks. A significant part of this plan involves when (or if) you get married or have children. Due to the skyrocketing costs of weddings nowadays, spending a significant amount of your earnings on a wedding and other big-ticket items generally causes you to have to retire later than people who save that money for retirement instead. Furthermore, if you don’t fix your credit, you run the risk of scrambling to pay off debts instead of funneling that money towards retirement. Furthermore, especially for people with lower levels of income, having kids is often one of the biggest factors affecting retirement savings. For instance, if you have a child closer to middle age, it’s likely that you’ll need to work longer and cut back on retirement savings a bit to cover the child’s living – and, often, college – expenses. On the other hand, if you finish having kids in your 20s or early 30s, you’ll often finish footing the bill for them by the time you reach middle age. The combination of higher earning power due to experience and no longer supporting your children equates to accumulating more money for retirement. HealthcareA couple that retires at age 65 today can expect to spend about $245,000 on healthcare throughout retirement, making it especially important to be conscious of your decisions surrounding healthcare when planning for retirement. Now that fewer employers are offering retirement health care benefits and health care costs are rapidly increasing, it’s becoming more important to think about what you want to do regarding catastrophic health care and long-term care costs when you retire. Once you’re no longer working, it’s likely that you’ll face increased costs for medical insurance coverage – despite Medicare. Because of this, consider buying supplemental Medigap insurance to pay Medicare deductibles and copayments, as well as to protect yourself against emergency health expenses. You should also consider planning for retirement-age long-term care. You may need long-term care when physical or mental disabilities impair your ability to manage basic, everyday tasks. Unfortunately, this type of care can be expensive, especially as people are starting to live longer. Consider purchasing long-term care insurance to help offset this and factor it into your retirement income needs. High and Low Risk InvestmentsDifferent types of retirement investments carry different risks, so it’s imperative to understand those risks and how they can affect your retirement income to best set yourself up for a comfortable retirement. This is especially true considering that men have a 78% chance of living to the age of 75 and women have an 85% chance, as the decisions you make about investment risk now can affect your life for possibly decades after you retire.

Basically, investment risk is derived from fluctuations in the market that can result in depletion of your retirement savings. You can generally assume that market fluctuations will average out over time, but it’s important to consider how much time you have to save up. Low risk investments provide lower returns and higher risk ones provide higher returns, so it can be tempting to put a lot of your retirement money into a high-risk investment. However, since the market doesn’t always provide positive returns and can provide negative returns for a few years at a time, it’s important to avoid high-risk investments when you’re close to retirement age. When you’re younger, you can afford the lulls associated with high-risk investing since there’s time to recoup losses. As you reach retirement age, it’s often a better strategy to have a mix of low- and high-risk investments to keep you comfortable. Thinking about saving up for retirement may not be the most glamorous use of your time, but it will certainly pay off in the future. By paying attention to your life choices now, you can set yourself up for maximum comfort as you age. What are some other important factors to consider regarding retirement savings?

Is lifelong learning a recipe for aging well? It is according to researchers. Here’s why your education should never stop, even when you’re well past traditional schooling age.

It’s hard to talk about well-being without encountering the ideas of lifelong learning. This is especially true for retirees, who can reap all sorts of benefits by enrolling in a class. Those benefits aren’t just intellectual benefits, either. Lifelong learning can benefit senior health and act as a preventative agent for some mental and physical ailments. Here’s how. 1. Taking Classes is a Good Way to Combat Restlessness

Many of the benefits of lifelong learning for retirees have to do with socialization. As people retire or begin to age, they are more likely to become restless, particularly those who live alone or haven’t replaced work with a hobby. If you have retired from your career and you are not an active part of a community, how do you spend your time? Take a class! This will allow you to meet new people and acquire new skills or knowledge.

You may think you can learn things from the comfort of your own home and your television set or computer. This may be true, the history channel has a wealth of educational programming, but it won't provide the same social opportunities. If you want to fight restlessness, you need to stimulate your brain through continued learning and social interaction. Why is social interaction important? Restlessness, if left unaddressed, can turn into loneliness.

Loneliness contributes to a number of health problems, including:

There are more health risks associated with loneliness, but this gives you an idea of how loneliness can negatively affect health.

Enrolling in a class helps enrich life on several levels, not the least of which is the social aspect. Whether it’s enrolling in a course at the local community college, gathering for classes near home in a senior living community, or participating in courses online, a class is social and helps seniors form bonds with like-minded individuals.

Social interaction and mental stimulation are great ways to combat restlessness, loneliness, or depression. 2. Always Learning Means Staying Sharp

After retirement, there’s less stimulation to keep us on our toes. Finding new challenges in a class can keep the mind sharp.

You never know, you may set out to sharpen your mind and find your passion along the way! Once your children have left the nest and you have retired from your obligations, it’s time to look inside yourself and find what makes you happy and what gives you purpose. Try new things! Take a dance class, learn to paint, expand your pallet and your recipe list. As you sharpen your skills you will be one step closer on the journey to finding your passion. 3. Classmates Can Become Friends

Another issue some people face after retirement is an ever-narrowing social network. Going back to school, whether it’s for accounting or basket weaving, can open up new channels of socialization as we meet people both inside and outside the classroom.

4. Learning Makes the World More Interesting

Maybe Gandhi said it best:

“Live as if you were to die tomorrow. Learn as if you were to live forever.” ― Mahatma Gandhi Learning about the topics you love, that spark your interest, can add a new dimension to life. Everyone benefits from broadening their horizons, even seniors who’ve already packed a lot of experience under their belts. A great way to continue learning and challenging yourself is to engage with your grandchildren or younger members of the community. As the old adage goes, everyone knows something you don’t – exchange experience and knowledge with younger generations. 5. Learning is Fulfilling

Many retirees and older Americans find a surprising challenge in their new lifestyle: how to stay busy with all that free time. Many miss a daily routine or a set schedule. A class can bring regularity to the week’s schedule that many crave, and fills the time in a way that makes one proud. Wouldn’t you rather end the day knowing you enriched and challenged your mind?

Have you ever considered learning a new language? This could provide new and exciting opportunities! You can make new friends, try a new restaurant that offers exotic cuisine, or even travel with your new ability to communicate and translate.

Click here for summer travel tips to start planning your future without (language) boarders!

6. Continuing Education May Help Reduce the Risk of Alzheimer’s Disease

A little earlier we mentioned that taking a class keeps the mind sharp, but did you know it can help prevent or delay disease? Continued learning has been shown to help stave off the kind of cognitive decline associated with Alzheimer’s disease, according to a study released in 2012. Again, it seems that daily challenge is good for the brain, just as daily exercise is good for the body.

Want more than just mental improvement? Physical exercise has also been shown to improve brain function and increase lifespan. Click here to continue your path to learning with 7 must-do exercises for seniors.

These are just a few reasons lifelong learning benefits senior health and keeps us younger. There are plenty of classes out there, so take your pick. If it’s not for you, try another until you find one you like. You’ll be improving your mental health and feeling younger while having a wonderful time.

At Acts Retirement-Life Communities, residents are encouraged to continue learning and use their skills to better their community. Since Acts offer’s maintenance-free, resort style living, residents are free to pursue their passions, pastimes, hobbies, and enjoy the multiple social opportunities offed. Being single at an old age could be as a result of three reasons. One is you choose not to be in a relationship until age caught up with them, or because the relationship you have been in is no longer working so you divorced, and lastly which is sad, you lost your partner through death. Either of the above, everyone needs a companion in life and especially when you are old. You need someone to share ideas with, to love and cherish, or even to have fun together. There are three common options for older singles who want to start dating. They are as discussed below. Dating people of your age groupFor some old singles, they prefer age mates. These will want to date someone they have the same life experience with. For some reason, they think younger people could be wasting their time. This is a group of singles who believe that they can’t learn anything new from the younger generation. They want to hang out with people of their age group because they can’t find fun in persons of different age group. Sometimes these are conservative people and don’t want exposure to any other generation. Well, this could be advantageous because as the old adage goes, “Old is Gold”. Old people are full of wisdom and for this category of singles; they know that this wisdom can only be found in their age counterparts. Another reason for this could be because they have children to take care of and they want age mates they can trust with their children. Not Specific to Age GroupThis is the group of senior singles who are open to having a relationship without being specific to a certain age bracket. These will register on dating sites for seniors and are open to anyone who is willing to mingle with them. May it be a young person or the older person, for them age is just a number. For these, they are looking for a mix of experience and value. They believe that they can learn from anyone and they can find love and fun in anybody irrespective of their age, as long as they admire the person. The Rich Want to Be a Sugar DaddyThese are opportunistic, and they know they can use their wealth to influence. These old folks are looking for the young and beautiful. This is the group that you will find hanging around college cafeterias poising as “hungry lions” they look around flashing their wealth singing “spend my money”. College girls are looking for sponsors. They want to find a sugar daddy to pay their bills and this is what these oldies want to satisfy in the lady. Well, some will do it with good intention, but others will be looking for fun only. They are wealthy, and they have the potential to pay the bills. ConclusionIn today’s lifestyle, being 50 and single is not a big issue. You can find love anytime you want, and all options are available. Dating is fun and gets better when you find a companion you can love and cherish.

Single seniors want to be loved too. In fact, this the time when you are less active, and you are thinking too much about your life. You are about to retire, and you will be lonely at home unless you really love the TV like Obama, but you will also find boredom in it. Well, Dating again or for the first time, is a good idea for you. You need someone to remind you important things you might forget because memory loss is related to your age. Here are some nice tips you need to be aware of before you start surfing about best dating sites for over 50. You Need Someone Who Can Help You Manage Your WealthYou are about to go on retirement, and the pension check is on its way. Older people have worked so hard for the many years, and they don’t want all the effort to go down the drain in a night. You need someone you can trust with your real estate business because you worked so hard to put up the apartments. It could be a bad moment if you date a person who will squander all your wealth and leave you bankrupt. This is a companion who will tell you “Honey, watch out you are about to sign a fake contract”. He or she is a person who has good will for you and wants you to prosper further. Next time you are looking for a companion, I hope this will make sense to you. You Need More Love and CareAs you age, you will not be able to do most of the things you can manage now. You need someone who will enable you to achieve the same things you are always ambitious to achieve. This is someone who will love you and care for you while enabling you. Medical care and physiological care are some of the things you’re newly found love should be able to give you. If you fall for a person who is not concerned about you and even worse doesn't love you, life will be stressful and will lose meaning. Sex Matters Even After 50What would dating be without sex? In any relationship, it complements the meaning. You need to have more and more of it to enjoy your life. It rejuvenates your body and makes you feel younger. Now that you are a retired general, you even have more time to enjoy sex don’t sit and let thoughts fill your mind. After retirement, you are less active, and you still have energy in you. Apart from going to the gym, enjoy sex while you still can. Final ThoughtsFirst things first! Get to know the person well and avoid regrets later. You are of age, and you don’t want time wasters nor do you want to regret for the rest of your time. Do your vetting well and be sure you found love, not just a lover.

The retirement years often have been called "the golden years." As with virtually everything else in life, however, whether or not your later years are golden is a matter of personal choice. You can choose to live a joy-filled retirement, full of new opportunities, new insights, new friendships, new activities, new experiences, and new time to explore many of the ideas you've always wanted to, but never had the time while you were raising your kids, building your career, and being scheduled to within an inch of your life. Or not. You can choose to shrivel up and die. You can brood about your aches and pains. You can feel angry that you were forced into retirement. You can lament your decreasing energy and stamina. You can excessively grieve for lost loved ones. You can feel very sorry for yourself. Is this really how you want to live? Then don't. What is Spirituality?Spirituality is a concept that means different things to different people. For some, the word is synonymous with religion. For others, it is the belief that there is a universal mind, a force if you will, that goes far beyond the superficiality of the "May the force be with you" slogan of the Star Wars saga. For still others, spirituality is the sense that everything in the universe - people, nature, the cosmos itself - somehow is connected and each individual is part of a much greater whole than possibly can be perceived, let alone explained. One writer phrased it thusly: "The basic meaning of spirituality is that it is a term which encompasses everything that we cannot see directly with our eyes, directly perceive by the other senses and know by our mere reason. That is spirituality in its basic meaning." Spirituality and AgingWhatever your own definition of spirituality, there is a general consensus that the older a person gets, the more spiritual he or she becomes. Why? Many theorize that it's because older people are more aware of their own mortality. They're no longer the indestructible teenager or twenty-something with an entire lifetime ahead of them and the belief, if they think about it at all, that death is only for :old people" and of course they're never going to be old. After retirement, however, people have the time - sometimes far too much time - to think about their own death, to think about the meaning of their own life, to think about what, if anything, they can do this late in life to become a happier, more fulfilled person. It's not "just" the big questions, it's also the personal, practical question of "What do I do now?" Spiritual Retirement CommunitiesMany spiritually-inclined retirees discover that moving to a retirement community populated by like-minded people is preferable to remaining in the home that may hold many wonderful memories, but also requires continual upkeep and maintenance. Not only are they relieved of the responsibility for cutting grass in the summer and shoveling snow in the winter, they also get almost daily opportunities to meet new friends and engage in activities they had no idea could be so enjoyable. For instance, many retirees receive great joy and comfort from pursuing non-denominational Biblical research such as that provided by The Way International The number of faith-based retirement communities has substantially increased as the American population continues to age. Nonprofit organizations own and operate up to 80 percent of continuing care communities, 75 percent of which are affiliated with various religions. This does not mean, however, that they are limited to people who share a common faith or denomination. People of different religious beliefs are welcome, as are people with no religious beliefs whatsoever. The accent is on spiritual living, not religion per se. Or as one such community expresses it, JCISC, an acronym standing for Jesus Christ in Street Clothes and meaning that community life is based on the values of joy, compassion, integrity, stewardship, and community. Giving BackThe American Association of Retired Persons (AARP) reports that retirees often feel the need to give back to their communities, fulfilling this need in any number of ways. From volunteering their time and talents at a library, a hospital, a church, a school, or an animal shelter to participating in "seniors helping seniors" programs, retirees get good things done and make good things happen. Their almost universal comments are that they are receiving far more than they're giving. Living a spiritual retirement can and does mean many things. It can and does encompass an almost limitless variety of ways in which to increase your own spirituality and happiness while doing good for both others and yourself. Yes, you actually will "do good" for yourself when you choose to live more spiritually. Research continues to show that people with a strong sense of spirituality are far less prone to both physical illnesses and psychological conditions such as anxiety and depression. The choice is yours. How do you want to spend your golden years?

With interest rates at an all time low, most retirees are keen to take a look at anything that could add to their retirement income. When we’re younger, stock market investments tend to be focused on capital growth because we’re trying to build up pension pots, or pay for children’s college fees. It takes a bit of refocusing to view the stock market in terms of what it can do to boost income. Many of us find in retirement that while we’ve retired, our brains haven’t. So share trading and investing can also become an interesting hobby. Where retirees can win out, is that they have more time to read up company backgrounds, so they can make better informed decisions. Additionally, a certain amount of detachment from the hurly-burly of working life can lead to more objective thinking and make older investors less likely to behave like sheep, following the market no matter what. How much risk can you handle?When you consider income from the stock market, you first have to decide how much risk you are willing to take on. If you have a limited income and little to spare, you need to be careful about risky investments. The safer choices will be well-established companies, in sectors that everybody needs, such as utilities. Go-go technology start-ups are probably best avoided – and in any case, many are famous for never paying dividends. The safer route – stocks that pay dividendsDividends from stocks are usually paid twice a year. When you go online and look up a stock, you’ll find the dividend expressed as a percentage of the share price. However, it’s easy to be misled. If you see a nice high dividend – say 10%, you should investigate further and prepare to be disappointed. This is because one way that a stock’s dividend goes sky high, is that its share price has taken a dive. Imagine that XYZ Corporation is trading at 3.00 per share, and paying a dividend of 5% - that’s 15.00 (pounds, dollars or euros, it makes no difference to this example).  Then something goes badly wrong and XYZ’s Chief Executive has to warn that profits for the year will be taking a hit. The share price falls to 150.00. But the dividend level quoted will be the last one that was paid – 15.00. This is now 10%. But we can be sure that the Chief Exec will be slashing the pay-out next time. So if you see a great dividend, use online charting tools (CMC Markets have some good ones), to take a look at the share price and dividends over the past year or two. You’ll find that the steady, regular payers are often quite expensive and their dividends are under 5%. But remember that over time, that dividend will rise. Trading for income There’s a different route to earning an income from the stock market, but it’s riskier and you should probably only use part of the money you have – and then make sure you wouldn’t be completely sunk if you lost that amount. This option involves trading online, where you can trade on margin – that means that you can buy stock without having to put up all the cash necessary. However, bear in mind that you are making a commitment to buy at that price. If the price suddenly drops, you may be asked to put more margin, as a security measure. There are many ways to trade on margin, including “spread betting” where you decide whether a stock will rise or fall, and stake money on it. Contracts for Difference (CFDs) are another variation of this. However they all come with a health warning – you can lose far more than your deposit if the bet goes wrong, so you need to use some of the control measures the brokers offer, such as “stop losses” – research these before plunging into day trading. That said, there are people who trade from their homes or while travelling, never holding a stock overnight, and make a living at it. Whatever your goals and intentions are when it comes to making money on the stock market be sure to make each decision with careful consideration as well as enjoying the experience to make your time really worth while. Retired Brains does not offer direct financial investment advice, nor do we affiliate ourselves with any particular financial advisers or firms in the United States or worldwide. Rather, the sole purpose of this article is to present educational, helpful information that can help you decide what kind of investing strategy is right for you in your retirement. If you are interested in learning more about property or pension fund investing, we recommend seeking out a reputable adviser or firm in your area for assistance.

The Types of Lift Chairs

There are three types of lift chairs you can choose from, each with its own benefits.

The first is the two-position lift chair. It is ideal for watching TV or reading. It will provide the option of a 45º recline, and the footrest will flip up. However, the design is made for the casual user, so the backrest will not work independently of the footrest. The advantage of the two-position chair is that it does not occupy as much space as the other two types. While it is comfortable and helpful, it is not suitable for people who need more support. The three-position lift chair has the benefit of reclining almost all the way. It is the best choice for people who want to replace their regular recliner. The backrest does not operate independently of the footrest, but unlike the two-position chair, the occupant can easily use it for naps and relaxing. Some models even have special features, like massaging and heating, which make the three-position chair ideal for seniors.

The infinite position lift chair, on the other hand, is everything you would want in a lift chair. First of all, two motors allow the footrest and the backrest to operate independently of each other. The occupant can decide which position is most comfortable. The infinite position chair was designed for people who would spend most of their days in it, which is why a variety of positions is needed. Individuals who suffer from hypotension will benefit a great deal from this chair, as they can sit in the Trendelenburg position. The point is that you can sit in it however you like. After all, it is called an infinite position lift chair. These too come with different features like massage and heating, and some even provide a sleeping mattress.

The Weight of the Occupant

Occupant weight is another aspect that you must take into consideration. Most models can hold a person who weighs 300 pounds. However, if the occupant is heavier than that, you need to read the fine print and make sure that the lift chair can hold that much weight. Otherwise, the motor (or motors) will not handle it.

The Height of the Occupant

Occupant height is particularly important because of the exit strategy and because the lifting must be executed in the safest way possible. It’s all about the distance a chair needs to lift off of the ground. A lift chair that was designed to lift a person who measures over six feet will require a higher lift than the one that was designed for a five-feet tall person.

A Lift Chair is an Investment so Choose Wisely

We understand that fabrics and colors are important for your comfort and aesthetic tastes. For example, some fabrics are more soft, durable, and easier to clean. However, please keep in mind that functional concerns can, like the ones mentioned above, bear more importance than just what a lift chair looks like. This is why choosing a lift chair should not be done in haste. Take your time and choose the best possible lift chair considering all the criteria we have discussed.... and get ready to enjoy your new investment!.

*Retired Brains does not offer lift chairs for sale, nor do we recommend any one particular type or brand of lift chair to our readers. Like any investment you make, we highly recommend researching the brand, cost and any other factors relating to your purchase, in order to ensure you have chosen the product that best meets your needs.

The image used in this article was created by Ted Kerwin and no alterations were made.

It’s a well known fact that many seniors like to travel when they retire. It makes perfect sense if you think about it. After all, you have the power to choose where it is you want to be, your children and grandchildren are busy with their own lives, and you have a lot of leisurely time on your hands. Traveling is the best way to spend your golden years.

A lot of boomers, seniors and retirees choose to go on cruise ships. It’s convenient, it’s not very expensive, you have everything you need on board, and you can have a lot of fun. Entertainment is not an issue. But have you ever thought of breaking out the mold a bit by doing something more exciting? A trip to India is definitely something everyone should do at least once in their lives. It’s a spiritually rich country that has a lot to offer. Check out the 5 best destinations for retirees below, and get ready to pack a bag or two! Goa

In Old Goa, you will find the beautiful Basilica of Bom Jesus. UNESCO has declared it a World Heritage Site. The baroque architecture is just breathtaking. The destination has won a Traveler’s Choice Award in 2017, and it wasn’t for nothing. The sandy beaches will provide a quiet and relaxing place where you can enjoy some curry and drink some Kingfisher beer. You will come back with beautiful pictures and great memories. At Christmastime, the East and the West come together culturally, and you will be enjoying a wonderful religious ceremony.

Jaipur

In Old Goa, you will find the beautiful Basilica of Bom Jesus. UNESCO has declared it a World Heritage Site. The baroque architecture is just breathtaking. The destination has won a Traveler’s Choice Award in 2017, and it wasn’t for nothing. The sandy beaches will provide a quiet and relaxing place where you can enjoy some curry and drink some Kingfisher beer. You will come back with beautiful pictures and great memories. At Christmastime, the East and the West come together culturally, and you will be enjoying a wonderful religious ceremony.

Agra

You can’t say you went to India without seeing the Taj Mahal. The whole trip is incomplete without it. It’s the biggest token of love known by man. The Taj Mahal was built by the Mughal Emperor Shah Jahan in loving memory of his favorite wife, Mumtaz Mahal. The beauty and the architecture of the palace are world famous, which is why it is considered one of the eight wonders of the world. In Agra, there are two other World Heritage Sites declared by UNESCO, the Fatehpur Sikri, and the sandstone Red Fort.

Rishikesh

If you want to have beautiful spiritual experiences, then Rishikesh is the place to go. It is located at the base of the Himalayas, and it is a very important cultural and spiritual location for the Hindus there. Sacred rivers are flowing through the mountains, and the yoga spots look as if someone cut them from a magazine. The Beatles went there in 1968 to get in touch with their Eastern spiritual side and wrote several songs at a local ashram.

Bengaluru

Bengaluru is also known as “The Silicon Valley of India.” It is a geek’s paradise but is also know for its cultural riches. You can visit plenty of gardens, museums, palaces, and temples. The natural features of the city are absolutely stunning. You can go to Cubbon Park and Ulsoor Lake of Bangalore. You will love the boating facilities. Also, Bengaluru has a lot to offer regarding music. It is one of India’s classical music and dance centers. There a lot of concerts you will surely enjoy.

Getting Your Travel Visa for India

Getting to India is not very hard, especially if you travel by plane, and getting a visa is easy as pie. You can apply for an India e-visa online in just a few minutes. You don’t have to spend hours sitting in line at the consulate, and you will have your visa in maximum three days. Just in case you cannot handle the bureaucracy, you will get assistance every step of the way. The service is there to help you 24/7. There is little you have to do. In this regard, the hardest part will be packing your bags!

Keep in mind that these 5 locations represent only a small portion of what India has to offer, but they are all worth visiting and are very popular with retirees. You’ll go back home with wonderful memories and stories to tell your grandchildren. You will also feel enriched in every possible way. Namaste!

Retired Brains is not a travel service, and does not offer direct travel support assistance. The purpose of this blog article is to provide helpful information on some popular locations in India should you choose to travel there. As with any international travel you undertake, we recommend researching local customs and other demographic data to ensure you are prepared for cultural immersion. You may also want to contact a travelers bureau in your area to find out about any international circumstances or situations, including safety concerns, that might affect your decision to travel abroad.

Advantages to Pension Fund Investing

A retirement pension fund is the typical method of retirement savings and investing. For this reason, it’s often viewed as the safer investment bet when you’re planning for your retirement. Pensions rarely lose money that is invested into them, although they may not grow dramatically, either. There are also extensive tax benefits involved when putting your retirement investing into a pension fund. If you choose to use a company pension program, the money you contribute towards your retirement will be pre-tax.

While this reduces your total taxable income in the present, you will be forced to pay taxes on your retirement savings later in life when you go to withdraw. On the other hand, if you invest in a private pension fund, the likelihood that you’ll invest from your net-income (or post-tax income) is high, and your withdrawals during retirement will be completely tax free. Regardless of which fund you choose, having tax benefits on the front or back end of your investing is a definitive benefit of pension fund investing.

Another advantage to pension funds is that, in many cases, an employer will contribute an equal amount up to a certain percentage of your pay towards your pension fund. These match programs can drastically increase your overall retirement savings, and if you contribute wisely at the beginning of your career, you’ll be able to earn interest on a greater amount of funds invested for a longer period. These extended earnings have the potential to set you up nicely in your retirement. Disadvantages to Pension Fund Investing

While pension funds do offer a secure way to invest and save for retirement, they can also be disadvantageous. The most notable disadvantage of pension funds is the lack of flexibility in when you can access your money. In most cases, you won’t be permitted to withdraw funds from your pension until you’re 55, and even then you’re subject to taxation. For those who are interested in possibly retiring early or taking an untraditional retirement in which they start a second career, go back to university, or choose to live internationally, these pension fund withdrawal limitations may be restricting.

Additionally, the performance of pension funds depends entirely on the investment of your assets. If you invest poorly, or in too conservative a way, your funds may not grow much, if at all. This means that your pension fund is essentially a glorified savings account with employer contribution and better than average interest. Still, for many, this isn’t enough for them to live the way they want to during their retirement. Advantages to Property Investing

When you choose to invest your retirement funds in property rather than a traditional pension fund, you have significantly more flexibility when managing your investments. For example, you can monitor the real estate market to select the perfect property investment, and from there you can choose to either live there full time, use the property as a vacation space, or make even more money on your investment by setting it up as a rental property. If you ever want to sell your property, it is a physical asset and you have the capability to do so. Whether you’ve decided you’d like to use your funds earlier than planned, or you are ready to invest them in another market, selling property is much easier than cashing out your pension fund early.

Additionally, the property market has more flexibility with the levels it can fluctuate. You can purchase a property in a buyer’s market and sell for significantly more in a seller’s market, often making much more on your investment than you would have made had you put the same funds in a traditional pension fund. Disadvantages to Property Investing

Admittedly, property investing is much less stable than pension funds. Property markets tend to fluctuate with some regularity and little to no warning. There are also more maintenance expenses and up front taxes involved with a property investment. These upfront expenses can often be a deterrent to those looking for investment opportunities, and few view an expensive property as a viable means to save for retirement as a result. Despite the inherent volatility of property investing, it can often be an excellent vehicle for those looking to invest or to access the return on their investments sooner than a pension fund would allow.

Should You Consider Overseas Property?

The answer to that is a glowing “yes, absolutely”. If you are going to go with property investing in spite of the inherent risk you should consider doing so abroad. Some countries like Romania can offer staggering returns of 7, 8 or even 9% annually. You could potentially diversify your overseas property investments over 4-5 developing countries (in which homes are very cheap in, with high annual rental yield) and minimize the risk, and be much better off upon pension.

You don’t have to worry about dealing with the nitty gritty. There are professionals in the field that specialize in dealing with foreigners. Lawyers, property agents, and international money transfer companies deal with tens of thousands of clients just like yourself.

What is the Bottom Line?

To each his or her own. Both options are valid, it just depends on how risk averse you are, and of course, your financial status. No matter whether you choose to invest in property or a pension fund, be sure to consult a qualified adviser who can help you make the wisest choice based on every factor affecting your decision.

Retired Brains does not offer direct financial investment advice, nor do we affiliate ourselves with any particular financial advisers or firms in the United States or worldwide. Rather, the sole purpose of this article is to present educational, helpful information that can help you decide what kind of investing strategy is right for you in your retirement. If you are interested in learning more about property or pension fund investing, we recommend seeking out a reputable adviser or firm in your area for assistance. What is Bridge?

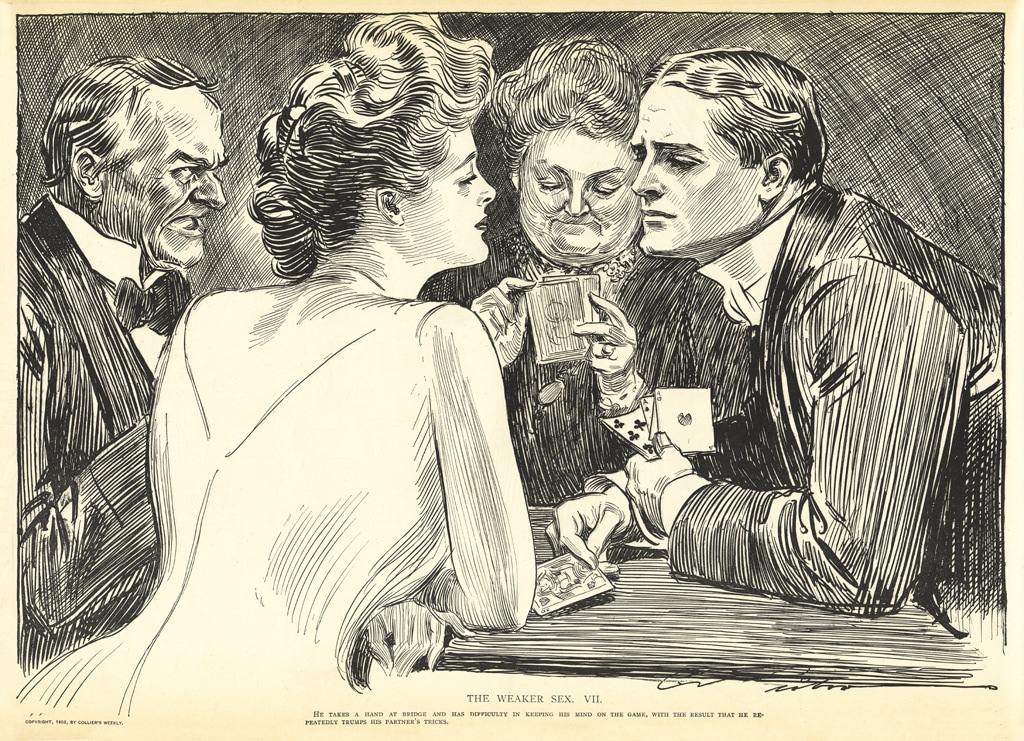

The Benefits of Playing BridgeHere at Retired Brains, we love helping you find activities that add value to your life. This includes leisurely pursuits that keep you socially active and mentally sharp. In this spirit, we are going to discuss the benefits of playing bridge, in order to help you decide if bridge might be a good activity to partake in. Some of the many benefits of playing bridge include:

Now, it is no secret that playing bridge is akin to mental gymnastics. In this regard, stimulating your brain regularly is believed to be an important component in warding off diseases including Alzheimer’s and Dementia. However, boosting immunity to ward off illness was not necessarily considered to be one of the benefits of playing bridge until the early 2000’s, when Professor Marian Diamond (no pun intended!) undertook an experiment at the University of California Berkeley with 12 ladies in their 70’s and 80’s. Professor Diamond began by taking a blood sample from each lady, and then had the group play bridge for 90 minutes. After that, she took blood samples again. She found that 8 of the 12 ladies had increased levels of T Cells in their bodies as a result of play. T Cells, of course, are used by the human body to fight infection. Professor Diamond’s hypothesis, that using the dorsolateral cortex of the brain by playing bridge can boost the immune system, was proven correct. Isn’t that neat? What is more, advances in modern technology mean you do not even need to leave the comfort of your home to enjoy the benefits of playing bridge! Why Play Online Bridge? Bridge is a natural game of choice for retirees, because retirement allows you to have more time on your hands to enjoy leisurely pursuits. For example, duplicate bridge typically allows for 7-8 minutes per hand, with anywhere from 22-26 hands per session. This means one session can take almost 3.5 hours to complete! Some people enjoy leaving the house to play bridge in community clubs.

If you choose to play online bridge, you can rest assured that your mental sharpness will still benefit from the strategy, deduction, concentration and visualization required. Furthermore, many online bridge sites have a ‘chat’ function, which means you are able to communicate with your partner and other players in live-time. This allows you to experience meaningful social interactions, and even make some new friends in the process. Another benefit, should you choose to play online bridge, is that many platforms are open for play 24 hours a day, 7 days a week, 365 days a year. So unlike a community hall with set hours of play, if you choose to play online bridge, you can do so whenever you wish! Playing Online with the Funbridge Download Retired Brains has found a fun, interactive and easy-to-use online bridge platform called Funbridge. Funbridge is an established bridge site that connects bridge players from all over the world. Funbridge has individual games, as well as many different kinds of tournaments you can participate in. To use Funbridge, you need to sign up for an account and download their free, easy-to-use application program for your desktop computer, laptop or mobile device. Once you sign up, you will automatically receive 100 free ‘deals’. You can use these free deals to help you decide if playing online bridge is the right fit for you. If you decide that it indeed is, you can purchase monthly packages, including unlimited play. Please visit the Funbridge website to learn more, and to see if their platform is right for you. No matter what leisurely pursuits you choose to partake in, we hope this article helps you find stimulating, meaningful activities that are right for you...and that add tremendous value to your retirement years! *The purpose of this article is to provide helpful information that allows you to make an informed decision as to whether or not playing online bridge is right for you. As with any online or in-person gaming platform, you should always do your research to make sure you understand the terms, conditions, costs and any other stipulations associated with membership. If you have any questions about the Funbridge platform specifically, we recommend contacting them directly. Image Credit: The image of British nobility playing bridge is used with the permission of Creative Commons licensing, and is courtesy of the MCAD Library. The image was originally created by Charles Dana Gibson in 1903 for Collier’s Weekly.

No matter your reasons for wanting to find temporary and part time jobs, it is important to know that you have more options than ever before when it comes to landing the perfect retirement job. Why Retired Workers are in DemandMore and more are opting to turn to workers with a more mature, loyal outlook on employment. Some of the reasons employers are gravitating toward retired workers to fill temporary and part time job positions include: