Should I Relocate?

...to another state?

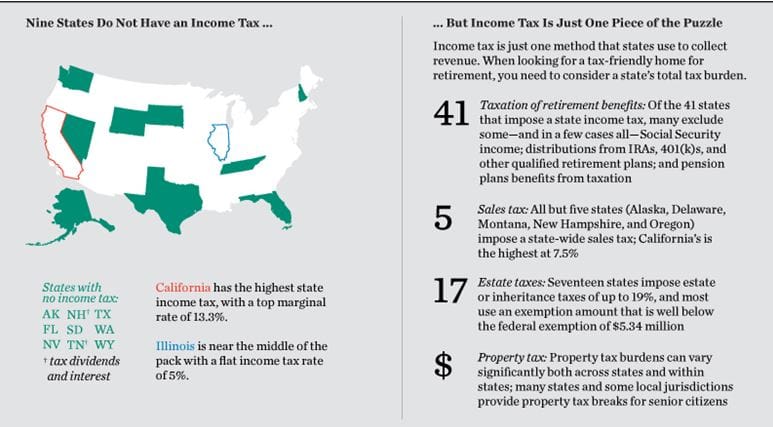

State income tax is only one consideration in choosing a retirement location; sales and usage tax, property tax, and estate tax, as well as how states tax retirement benefits should be considered. In Illinois, for example, the state’s 5% income tax does not apply to Social Security income; distributions from IRAs, 401(k)s, and other qualified retirement plans; and qualified pension plans. Your financial adviser should help you evaluate all of this information prior to making your decision.

In addition to having a warm climate, Florida, Texas, and Nevada are popular retirement destinations because they are three of the nine states that do not have a state income tax. FYI California has a top marginal state income state rate of 13.3%.

Take under consideration when you consider remaining in the state in which you currently live.

State income tax is only one consideration in choosing a retirement location; sales and usage tax, property tax, and estate tax, as well as how states tax retirement benefits should be considered. In Illinois, for example, the state’s 5% income tax does not apply to Social Security income; distributions from IRAs, 401(k)s, and other qualified retirement plans; and qualified pension plans. Your financial adviser should help you evaluate all of this information prior to making your decision.

In addition to having a warm climate, Florida, Texas, and Nevada are popular retirement destinations because they are three of the nine states that do not have a state income tax. FYI California has a top marginal state income state rate of 13.3%.

Take under consideration when you consider remaining in the state in which you currently live.