Identity Theft Against Seniors

Senior Citizens Identity Theft Prevention

According to the Federal Trade Commission, identity theft of senior citizens has nearly tripled over the past several years. In the United States, identity theft affects almost 500,000 senior citizens annually. Senior citizens are at an increased risk of identity theft, because they are often unable to monitor their accounts carefully.

Since Medicare uses Social Security numbers as identification, failure to keep this information private and secure increases identity theft among senior citizens. Additionally, according to a study by the Federal Reserve, almost 80% of senior citizens have credit scores of 701 or better. Good credit equals easy access to many goods and services, making senior citizens targets for identity theft.

Since Medicare uses Social Security numbers as identification, failure to keep this information private and secure increases identity theft among senior citizens. Additionally, according to a study by the Federal Reserve, almost 80% of senior citizens have credit scores of 701 or better. Good credit equals easy access to many goods and services, making senior citizens targets for identity theft.

Identity Theft and Scams Prevention1. Never give your personal information to anyone you don’t know and trust, including:

2. Carry as little identification as needed, while keeping your Social Security and other important cards in a safe and secure location. Secure locations include:

|

Who Can You Trust With Your Personal Information?Who Can You Trust?

|

|

3. Do not sign the back of your debit and credit cards

4. Do not carry these in your wallet or purse:

|

Creating Secure PasswordsThe best passwords are a combination of numbers, letters and symbols. Never use your birthday, anniversary, the names of pets, spouses, children or grandchildren—or any other information a thief can easily find out about you and your loved ones.

|

\n\n\n

5. Make a 2-sided photocopy of every piece of identification in your purse or wallet, including your passport if you are traveling overseas. Store it in your secure location.

6. Do not leave personal information in your car

7. Make sure all of your electronic devices have secure passcodes

8. Shred all sensitive documents, including:

9. Close any old or unused credit card accounts you do not use

10. Take identity theft precautions for credit or debit cards, and any other identification you carry, by purchasing wallet-style RFID (Radio-Frequency Identification) sleeves, because:

- If you are traveling overseas, keep your copies with a trusted person back home who can access them should you need this information.

6. Do not leave personal information in your car

7. Make sure all of your electronic devices have secure passcodes

8. Shred all sensitive documents, including:

- Bank Statements

- Medical Bills

- Social Security Statements

- Credit Card Slips and Receipts

9. Close any old or unused credit card accounts you do not use

- Also, place a freeze on your credit bureau account with the 3 main credit agencies if you do not plan on opening new charge accounts

10. Take identity theft precautions for credit or debit cards, and any other identification you carry, by purchasing wallet-style RFID (Radio-Frequency Identification) sleeves, because:

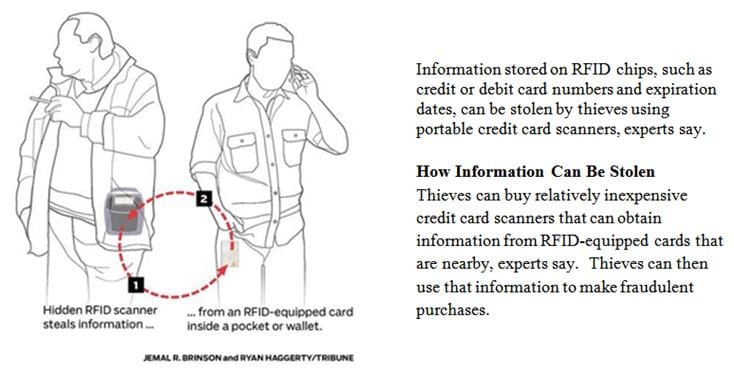

- Portable RFID Scanners are the newest tools thieves use to electronically steal personal information

- These scanners obtain personal information from any credit or debit cards and passports that use RFID technology

- This is called ‘virtual pickpocketing’, because thieves only need to be near you in order to obtain your information and commit identity theft

Electronic Pickpocketing

If you are interested in purchasing sleeves to protect your credit cards, passport, driver’s license or any other RFID based identification, contact John at john.lafayette@idstronghold.com

(Leather men’s and women’s RFID protected wallets are also available individually and in quantity)

(Leather men’s and women’s RFID protected wallets are also available individually and in quantity)

Don't be a Victim of Senior Identity Theft and Scams

If for any reason you are apprehensive or physically unable to take these precautions, we urge you to seek out a trusted family member, friend or agency to help. The senior citizens most at risk of identity theft are the ones who do not take the measures to prevent it from happening in the first place.

- To learn about common frauds and scams against senior citizens, please click here....