Why Delay Retirement

Fifty percent of oldest boomers are working full-time; about one-fifth are fully retired. One in ten is on disability and only 9% are currently collecting Social Security retirement benefits. Four in ten U.S. workers are planning to delay their retirement, according to a survey of nearly 9100 employees by Towers Watson.

It seems a large percentage of older workers are prepared to spend less time in retirement and to secure their retirement years financially they are willing to work longer thereby building a larger retirement nest egg through increased savings and continuing their healthcare benefits until they are Medicare eligible. 70 % of Americans ages 45 to 74 plan to work in retirement--both for enjoyment and because they need the income, according to a recent AARP survey.

The survey found that 40% of workers are planning to retire later than they were just two years ago. Older workers and those in poor health comprise the largest percentage of employees planning to delay retirement. In particular, 45% of employees in poor health plan to postpone their retirement.

Confirming this, when asked why they are choosing to retire later, more than two thirds of older workers indicated it was to keep their health-care coverage and 62% said it was because of the higher cost of health care. And 61% said it was because of the decline in the value of their 401(k) plan, value of their home or other retirement savings.

According to a report by Financial Engines most Americans are not on track to retire due to low savings and poor investment choices. Financial Engines further projects that typical Americans will be able to replace only 45% of their pre-retirement income, when 70% is necessary.

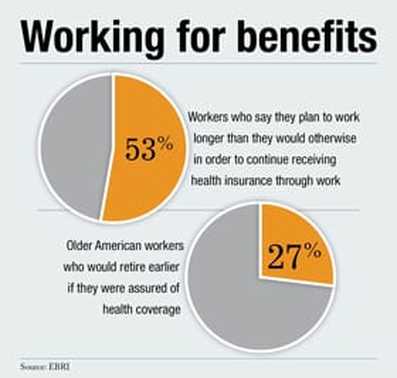

According to research by the Employee Benefit Research Institute, more than half of older workers say working longer is necessary in order to keep receiving employer-sponsored health insurance.

Health care costs comprise a significant chunk of seniors’ total spending: 9 % for those adults 50 to 64, 12% for those 65-74, and 15% for those 75-84.

Many Americans will have to work past 70 to retire and live anywhere near the lifestyle they had hoped for during their retirement years. AARP studies indicate that many Americans will have to work longer, whether it’s to age 70 or beyond. Not only will this give them a chance to save more and defer taking money out of their retirement plans for what will be a shorter retirement period, but they will have less health care expense during these additional years of work and since they will also be delaying taking your Social Security, this benefit will increase as well.

It seems a large percentage of older workers are prepared to spend less time in retirement and to secure their retirement years financially they are willing to work longer thereby building a larger retirement nest egg through increased savings and continuing their healthcare benefits until they are Medicare eligible. 70 % of Americans ages 45 to 74 plan to work in retirement--both for enjoyment and because they need the income, according to a recent AARP survey.

The survey found that 40% of workers are planning to retire later than they were just two years ago. Older workers and those in poor health comprise the largest percentage of employees planning to delay retirement. In particular, 45% of employees in poor health plan to postpone their retirement.

Confirming this, when asked why they are choosing to retire later, more than two thirds of older workers indicated it was to keep their health-care coverage and 62% said it was because of the higher cost of health care. And 61% said it was because of the decline in the value of their 401(k) plan, value of their home or other retirement savings.

According to a report by Financial Engines most Americans are not on track to retire due to low savings and poor investment choices. Financial Engines further projects that typical Americans will be able to replace only 45% of their pre-retirement income, when 70% is necessary.

According to research by the Employee Benefit Research Institute, more than half of older workers say working longer is necessary in order to keep receiving employer-sponsored health insurance.

Health care costs comprise a significant chunk of seniors’ total spending: 9 % for those adults 50 to 64, 12% for those 65-74, and 15% for those 75-84.

Many Americans will have to work past 70 to retire and live anywhere near the lifestyle they had hoped for during their retirement years. AARP studies indicate that many Americans will have to work longer, whether it’s to age 70 or beyond. Not only will this give them a chance to save more and defer taking money out of their retirement plans for what will be a shorter retirement period, but they will have less health care expense during these additional years of work and since they will also be delaying taking your Social Security, this benefit will increase as well.

Working longer tends to lead to a healthier life

Employed older adults tend to be healthier, both mentally and physically, than their nonworking peers. A study in the journal Preventing Chronic Disease finds that working in one's 60s and 70s is associated with better physical and mental health. When data was analyzed from more than 85,000 adults age 65 and older. (The mean age was around 75.), in general, those who kept working were nearly three times as likely to report being in good health than those who had retired. The study found that all types of workers reported better mental health, compared with those who were retired or unemployed.

Costs of health care after Medicare kicks in

A 65-year-old couple retiring in 2013 with Medicare insurance coverage will need approximately $276,000 to cover medical expenses over the course of 20 years, according to Fidelity Investments. This estimate includes deductibles, coinsurance costs, likely out-of-pocket expenses, and some services excluded by Medicare. The figure does not include over-the-counter medications, most dental services, and most long-term care expenses and perhaps a good deal more if they need to use a nursing home.

For those who are interested in continuing to work in some capacity, whether it be for an employer, for yourself, in a business you have started, or are just interested in seeing what others have done, I have provided additional information and appropriate links.

For those who are interested in continuing to work in some capacity, whether it be for an employer, for yourself, in a business you have started, or are just interested in seeing what others have done, I have provided additional information and appropriate links.

Use the RetiredBrains search engine to help find a job

If you are interested in using the RetiredBrains search engine to find a temporary, seasonal, part-time job or project assignment, here are suggestions on how to do so. Click here to go to our view jobs area and enter the job title in the keywords box. You can also search by location and if you wish to search by job title only check the box.

You can also place the word "temp" or "temporary" or "part time" in the keywords box if these kinds of employment are of interest to you. You may have to do a dozen or more searches using different job titles to find the job you are seeking. Unfortunately our search engine can only use the input employers posting jobs have entered so many of the results of a search will not match the search criteria you enter.

Remember to save any search you wish to return to so you don't have to re-initiate it from the beginning. Lastly once you have registered you can set a job alert so the system will notify you when an appropriate job is posted. You can do this as part of any search just by clicking on the "Job Alert" tab.

You can also place the word "temp" or "temporary" or "part time" in the keywords box if these kinds of employment are of interest to you. You may have to do a dozen or more searches using different job titles to find the job you are seeking. Unfortunately our search engine can only use the input employers posting jobs have entered so many of the results of a search will not match the search criteria you enter.

Remember to save any search you wish to return to so you don't have to re-initiate it from the beginning. Lastly once you have registered you can set a job alert so the system will notify you when an appropriate job is posted. You can do this as part of any search just by clicking on the "Job Alert" tab.

Help writing or rewriting your resume

We have a section which provides help on rewriting your resume Click here.

Use RetiredBrains to explore the many work from home opportunities

Click here for information on: Telemarketing, Direct Selling, Writing or Editing, Translating On-line, Becoming a Virtual Agent, Becoming a Chef Consultant, Medical Transcription, Becoming a Tutor, Selling On-Line, Selling at a Flea Market, Freelancing.